Looking for the very best Savings Account UK options? Honestly, you’re probably not seeing the whole picture! While the big banks shout loudly about their standard accounts, I’ve found they often keep the surprisingly impressive rates hidden away, almost in plain sight.

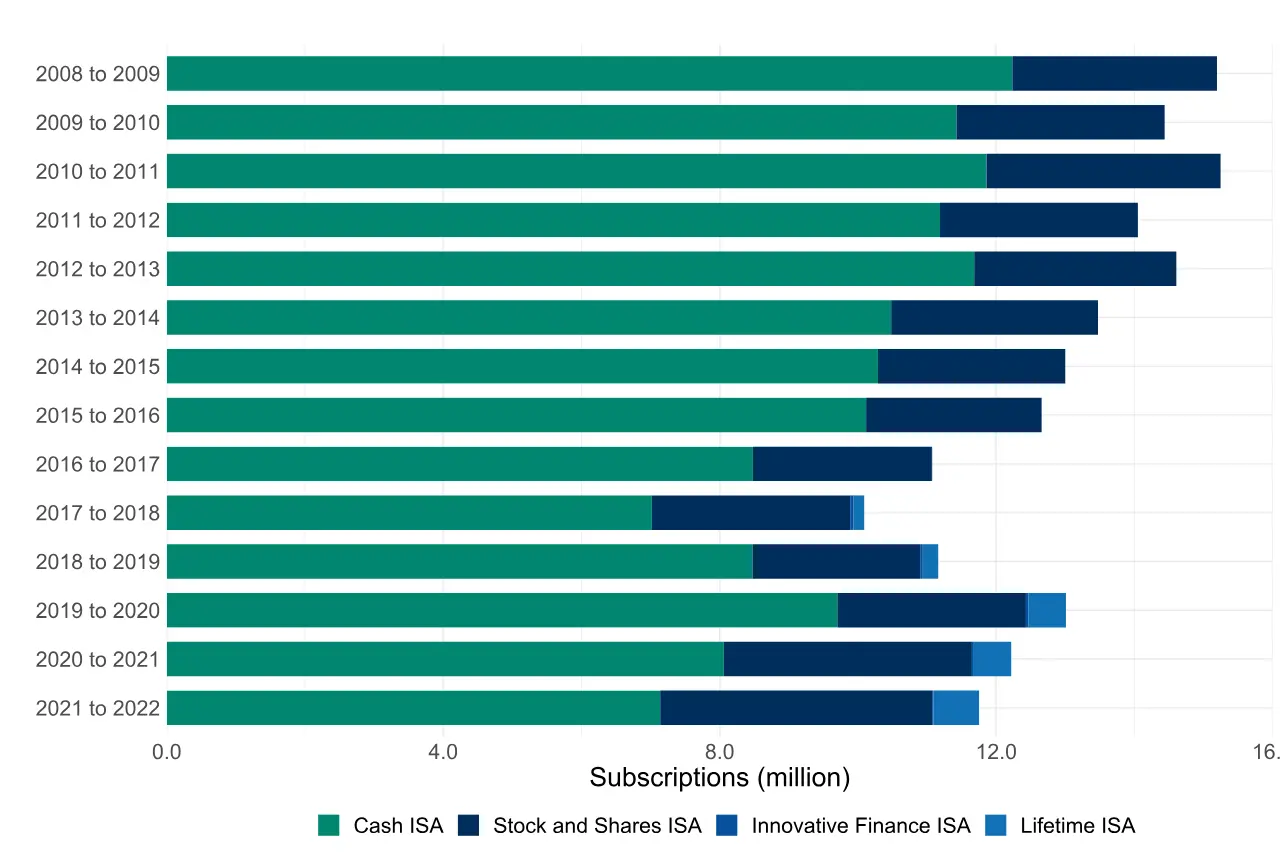

The savings scene is actually much more promising than most of us realise. Regular saver accounts are offering rates as high as 7.5% with Principality (though that’s capped at £200 a month). That’s a heck of a lot better than typical easy access accounts, which usually top out around 5.00% AER. And get this, First Direct and The Co-operative Bank are both offering 7% regular saver deals if you’re already a customer with them. Plus, if you’re savvy, Cash ISAs can give you rates up to 5.71% AER. Even those digital-only banks are getting popular, with places like Access Bank and Tandem Bank offering competitive rates like 4.55% for one-year fixed-rate accounts.

With UK inflation falling to 2.6% in March, finding the highest interest rate savings account is even more valuable right now. But, here’s a little heads-up: financial experts are predicting the Bank of England will probably cut interest rates soon. That means savings account rates across the board could drop. So, it’s super important to try and lock in the best savings rates the UK has to offer before they vanish! Thinking about your finances carefully now can really pay off, a bit like when you’re trying to improve your credit score.

I’ve done a bit of digging and uncovered 8 hidden savings options that most banks don’t really shout about – even though they have some brilliant benefits. These aren’t just the accounts with the best interest rates; they’re actually specific financial tools designed for different savings goals, and most people just don’t know they even exist!

Lifetime ISAs: Your First Home & Retirement Booster

Image Source: GOV.UK

Honestly, the Lifetime ISA (LISA) is one of the most generous yet least talked about savings schemes here in the UK. You’ll find banks rarely shout about them, but these accounts offer fantastic value if you have specific savings goals. I think it’s a brilliant option if you’re looking for a special type of Savings Account UK can offer.

Lifetime ISA Features: What You Need to Know

So, what’s the deal with a Lifetime ISA? Well, the big headline is the amazing 25% government bonus you get on your contributions – that’s basically free money! To open one, you need to be between 18 and 39 years old. Once it’s open, you can keep paying into it until you hit 50, though the government bonus does stop then.

You can pop up to £4,000 into your LISA each tax year. This £4,000 is part of your total annual ISA allowance, which is £20,000 for the 2025-26 tax year. The really great bit? That 25% bonus doesn’t count towards your allowance – it’s genuinely extra cash on top!

LISAs come in two main flavours:

- Cash LISAs (these are a bit like your regular savings accounts).

- Stocks and Shares LISAs (these are investment accounts).

Which one you go for really depends on how long you’re planning to save for and how comfortable you are with risk. You can also move your LISA between different providers if you find a better rate, although many will only let you transfer in if you’re still aged 18-39. It’s always worth comparing, just like you might with Cash ISAs.

Lifetime ISA Interest Rate: Watching Your Money Grow

With a Cash LISA, you’ll earn a variable interest rate on whatever you save, plus that lovely government bonus. And the interest is paid tax-free on both the money you put in and any bonuses that are already sitting in the account. Even better, this interest doesn’t nibble away at your Personal Savings Allowance. This means you can still earn up to £1,000 a year tax-free from your other savings if you’re a basic-rate taxpayer (or £500 if you’re a higher-rate taxpayer).

One of the best things is that you get compound interest. This means you earn interest on your interest, as well as on your initial savings and those government bonuses. So, your money can grow much faster over time!

If you go for a Stocks and Shares LISA, instead of getting a set interest rate, your money has the chance to grow through investment returns. This does carry more risk, but it could give you better results in the long run. This is especially true if you’re saving for retirement, or if buying your first home is still a good few years away and you’re okay with a bit of a gamble with your money.

Lifetime ISA Access Rules: The Important Bits

Now, the rules for getting your money out are what make LISAs a bit different from other savings accounts. First off, you have to wait 12 months after opening your LISA before you can use the money to help buy a property. After that initial year, you can take your money out without a penalty for only three specific reasons:

- Buying your very first home (and the property has to be valued at £450,000 or less).

- After you turn 60.

- If you’re unfortunately diagnosed with a terminal illness and have less than 12 months to live.

If you’re using it for your first home, the property must cost £450,000 or less, and you need to be buying it with a mortgage. You also can’t use your LISA money if you’re getting a private mortgage from a relative. When you’re ready to buy, the money goes straight from your LISA provider to your solicitor or conveyancer, not to you.

If you take money out for any other reason, there’s a 25% government charge. And be careful, because this isn’t just them taking the bonus back – it actually means you lose some of your own money too. For example, if you put in £4,000 and get the £1,000 bonus (making £5,000 in total), taking it out for an unapproved reason would mean a £1,250 charge. So, you’d only get back £3,750 – that’s less than you put in! Effectively, taking money out when you’re not supposed to costs you about 6.25% of what you originally saved.

Lifetime ISAs: Who Are They Best For?

So, who really gets the most out of a LISA? I’d say they’re ideal for two main groups of people:

First-time homebuyers: If you’re saving up for a deposit on your first place, a LISA offers amazing value. Each person can have their own LISA, so if you’re buying as a couple, you can both get the government bonuses! Imagine saving the maximum of £4,000 a year for ten years – you’d get a whopping £10,000 from the government in bonuses alone. That could be the difference that helps you get onto the property ladder. Understanding your finances is key here, a bit like when you’re trying to improve your credit score.

Long-term retirement savers: While they’re not exactly the same as pensions, LISAs can be a great alternative or an extra way to save for retirement. I think they’re particularly good for:

- Self-employed people who don’t have a workplace pension.

- Basic-rate taxpayers.

- Anyone who has already paid the maximum they can into their pension.

To make the smartest choice, think about how long you’ll be saving for. Cash LISAs are generally better if you’re planning to buy a home within the next five years. Stocks and Shares LISAs usually suit longer-term goals, like saving for retirement.

Unlike your standard savings accounts, the LISA gives you generous government help on top of being tax-efficient. However, those strict withdrawal rules mean you really need to be sure about your savings goals before you open one. If you’re not sure when you’ll need the money, or if you might need it for something other than buying a house or for retirement, other types of savings accounts might be a better fit for you.

Help to Save Accounts: A Hidden Gem for Lower Earners

Image Source: GOV.UK

Now, here’s a real hidden gem in the UK savings world that I think is brilliant: the government-backed Help to Save scheme. It’s designed especially for people on lower incomes, and honestly, it offers an amazing bonus that you just don’t see advertised by the traditional banks.

Help to Save Features: What Makes It Special?

Help to Save works a bit differently from your everyday savings products. To qualify for this account right now, you need to be a UK resident and getting Universal Credit with earned income of £1 or more in your last monthly assessment period. Or, you can get one if you’re receiving Working Tax Credit, or you’re entitled to Working Tax Credit and also getting Child Tax Credit.

The really standout part of this account is the fantastic government bonus – they give you 50p for every £1 you save over a four-year period. That’s like getting a 50% return on your savings, which is way better than what you’d usually find with a standard Savings Account UK option.

Here are the main things to know about who can get one:

- You need to be living in the UK (though there are some exceptions if you’re a Crown servant or in the armed forces serving overseas).

- You must be receiving those qualifying benefits I mentioned above.

- If you and your partner claim Universal Credit jointly, you can actually each open your own separate Help to Save account.

What I think is really good is that you can keep your Help to Save account even if you stop claiming benefits after you’ve opened it.

Help to Save Interest Rate: It’s All About the Bonus!

Unlike accounts that offer the “highest interest rate savings account,” Help to Save doesn’t pay you regular interest. Instead, it gives you big, tax-free bonuses at set times.

Your first bonus comes after two years. It’s a payment equal to 50% of the highest balance you managed to save in your account during those first two years. So, for example, if you save the maximum £50 every month for those two years (that’s £1,200 in total), you’ll get a lovely £600 bonus.

Then, you get a second bonus after four years. This one is 50% of the difference between your highest balance in the first two years and your highest balance during years three and four. So, if you carry on saving £50 a month during the third and fourth years (another £1,200), you’ll get another £600 bonus.

This means you could get a total of £1,200 in bonuses over the four years the account runs for. That makes it one of the “best savings rates UK” can offer if you’re eligible! Managing your money when on a lower income can be tough, so schemes like this, and knowing if you’re eligible for things like a Council Tax Reduction, can make a real difference.

Help to Save Access Rules: Paying In and Taking Out

When it comes to putting money in, you can save between £1 and £50 each calendar month. You don’t have to put money in every single month, which is flexible. But, once you’ve hit that £50 limit for the month, you can’t add any more until the next month starts.

So, for example, if you’ve saved £50 by the 8th of January, you wouldn’t be able to pay any more in until the 1st of February.

What about getting your money out? Well, the account works like an easy-access savings product, meaning you can take your money out whenever you need to without any penalties. However, the money can only be paid into your nominated bank account, and it usually takes about three working days to get to you.

It’s important to know that taking money out will affect your potential bonus. Because the bonuses are worked out based on the highest balance you reach, if you withdraw funds, your maximum possible bonus will be lower unless you manage to pay that money back in.

The account will automatically close four years after you open it. When it closes, all your savings and your final bonus will be paid into your chosen bank account. You can’t reopen it or open another Help to Save account after that.

Help to Save: Who Is It Best For?

This scheme is really brilliant for people who:

- Are receiving those qualifying benefits and want to start building a savings habit.

- Can regularly put aside even small amounts (every £1 helps!).

- Plan to leave their savings untouched for as long as possible to get the biggest bonuses.

Thinking about your benefits, it’s good to know that your Help to Save balance generally won’t affect your Universal Credit payments unless your total savings (including what’s in this account) go over £6,000. So, for most people, it’s a chance to save without it messing with their benefit payments straight away.

Because you can only open it for four years and it takes a few days to get your money out, Help to Save is probably best seen as a way to save for medium-term goals, rather than as an emergency fund.

One last important thing: before April 2025, people on Universal Credit had to earn around £793.17 a month to qualify. But now, that rule has changed, and you only need to have £1 of earned income in your assessment period. This is great because it means the account is now open to many more people.

I really believe this account is one of the “best interest rate savings accounts” for anyone who’s eligible. It offers amazing returns that you just won’t find with standard bank products.

Regular Saver Accounts: The Banks’ Best Kept Secret?

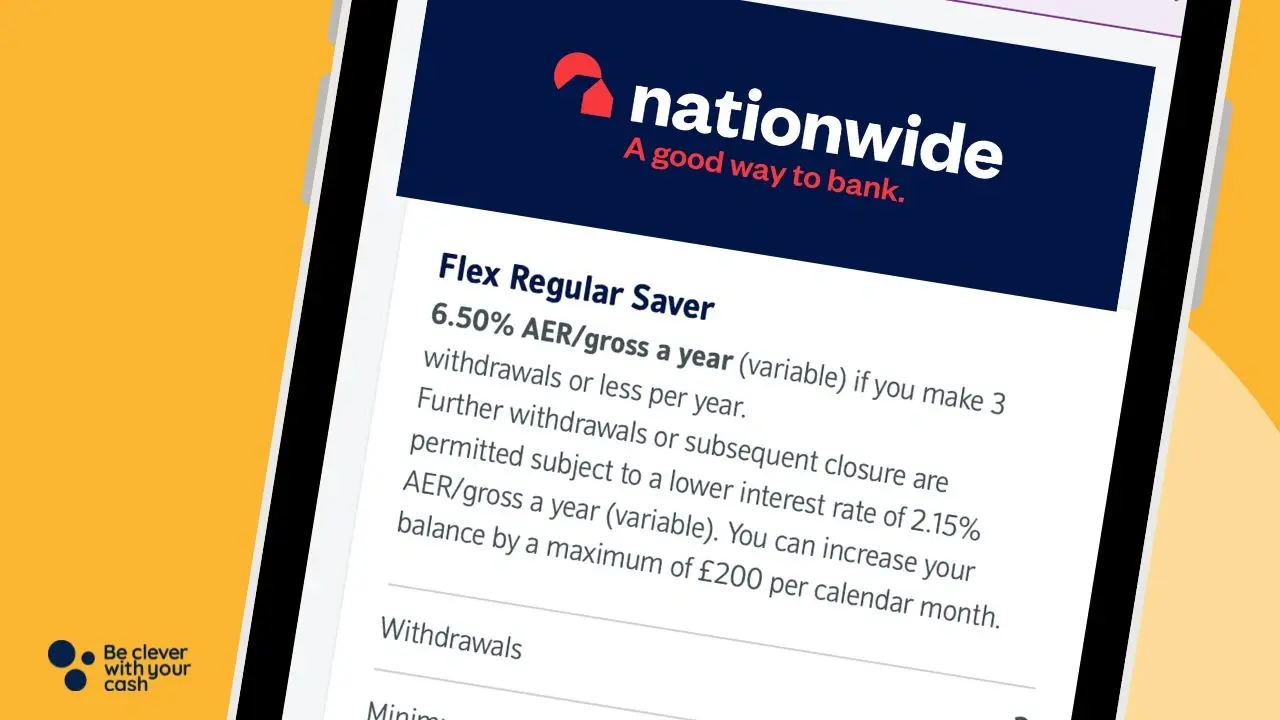

Image Source: Be Clever With Your Cash

I’m going to let you in on a little secret: Regular Saver accounts are one of the UK banking industry’s best-kept secrets, I reckon! They offer incredibly high interest rates compared to your standard savings products. These special accounts are brilliant because they reward you for saving regularly, often giving you returns that can double what you’d get from an ordinary easy-access account.

Regular Saver Features: What’s the Deal?

So, how do these work? Well, these accounts usually have a fixed term, typically for 12 months. You’ll need to pay in money each month, and there are usually limits on how much. Many banks will cap what you can put in at somewhere between £25 and £300 a month. For example, First Direct lets you save between £25 and £300, and The Co-operative Bank allows up to £250 each calendar month.

The key thing about these accounts is that you have to save regularly. First Direct, for instance, asks for a minimum monthly deposit of £25. The Co-operative Bank, on the other hand, doesn’t actually make you pay in a minimum amount each month. After the term is up, most of these accounts will either renew or change into a standard savings account.

One really important thing to know is that these top-rate accounts are often just for existing customers. To get the very best rates, you’ll usually need to have a current account with that bank first. For example, to get The Co-operative Bank’s Regular Saver, you “must already have one of our Co-operative Bank current accounts before you apply”. It’s a bit of a catch, but worth it for the rates!

Regular Saver Interest Rates: The Juicy Bit!

Right now, the best regular saver rates are smashing what you can get from standard savings products. Just take a look at these:

- Principality Building Society is offering a fantastic 7.5% AER (that’s fixed for 6 months).

- First Direct gives you a handsome 7% AER (fixed for 12 months).

- The Co-operative Bank also offers 7% AER (but this one is variable for 12 months).

- Nationwide has one at 6.5% AER (variable for 12 months).

How the interest is worked out can be slightly different from bank to bank. First Direct calculates your interest every day based on how much is in your account, plus any interest you’ve already earned. Nationwide does something similar, working out your daily interest by dividing the annual rate by 365.

Here’s a crucial point I want you to understand: the actual return you get works out to be about half the advertised rate. Why? Because you’re putting money in bit by bit each month, not as one big lump sum at the start. For example, that Saffron 9% saver someone mentioned actually gives you about 4.87% back on the total amount you’ve saved over the whole year. Still good, but it’s important to know how it really works!

Regular Saver Access Rules: Can I Get My Money?

The main trade-off for getting these higher interest rates is that there are usually restrictions on getting your money out. And these can vary a lot!

First Direct, for example, doesn’t let you take out bits of your money. If you need to withdraw anything, you have to close the whole account. If you do that before the 12 months are up, you’ll only get their standard savings account interest rate, not that lovely premium one.

In contrast, The Co-operative Bank lets you access your money “at any time, whether that’s online, through our mobile app, by telephone, or in branch”. Nationwide is a bit similar; they let you make three withdrawals during the term without losing interest. But, if you make a fourth withdrawal, your interest rate drops right down to just 1.50%.

When the account matures (usually after 12 months), most banks will automatically move your balance into one of their standard savings accounts. The Co-operative Bank, for instance, shifts everything into a Smart Saver account after the year is up.

Regular Savers: Who Are They Perfect For?

So, who are these accounts really good for? I think they’re ideal for:

- People who save regularly and can commit to putting money away each month.

- Existing customers of a bank who want to get their hands on premium rates.

- Savers who don’t mind some restrictions on accessing their money in return for higher interest.

- Anyone trying to build up good savings habits, as the regular commitment really helps.

If you’re saving for the first time, these accounts can be a brilliant way to get into a good routine. The structured nature helps you save consistently, and those higher interest rates feel like a real reward for your effort. These accounts can also be great if you’ve got a larger amount of savings and want to make the most of your returns. A clever trick is to keep the bulk of your money in an easy-access account but then “drip-feed” the maximum monthly amount into a regular saver. It’s a smart way to manage your money and could be a good strategy when you’re learning how to improve your credit score by being sensible with your finances.

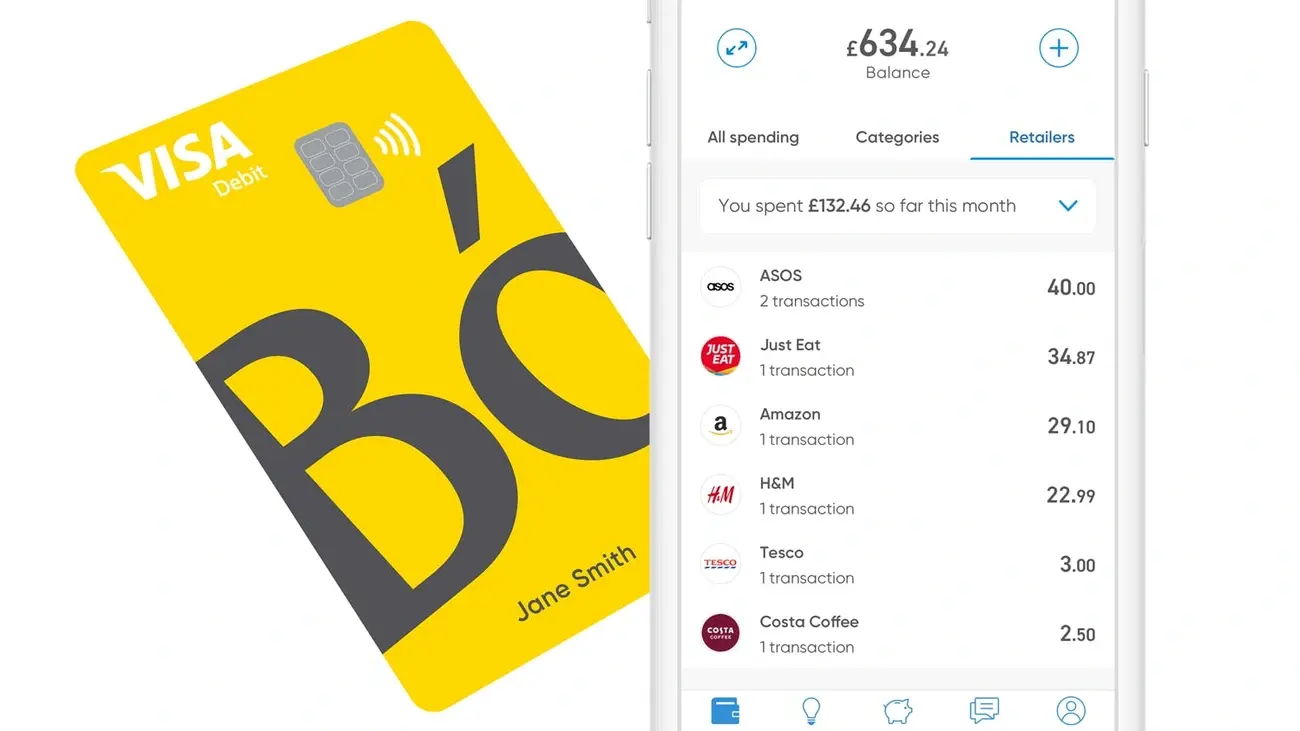

App-Only Savings Accounts: Smart Savings on Your Smartphone!

Image Source: Money Saving Expert

I’ve found that app-based savings accounts have popped up as really powerful alternatives to the old-school banks. They offer slick services and often much better rates because they don’t have the costs of running physical branches. These digital-first ways of managing your money are a breath of fresh air, and honestly, it’s the kind of Savings Account UK banks don’t often shout about!

App-Only Account Features: What Makes Them Tick?

App-only savings accounts make banking incredibly simple. Setting one up usually takes just a few minutes – I’ve heard some providers say you can do it in five minutes flat! Once you’re in, managing your account is super easy using their straightforward smartphone apps.

Here are some of the standout features I’ve noticed:

- Super Secure Logins: Many use fingerprint scans or facial recognition to log you in, which is both easy and secure.

- Virtual Savings Pots: You can often create little “pots” or “spaces” within the app to save for specific goals. I find this really helps keep things organised!

- Automatic Round-Ups: Some apps will automatically round up your card purchases to the nearest pound and pop the spare change into your savings. It’s amazing how quickly this adds up!

- Real-Time Notifications: You get instant alerts when you spend or save money. This is brilliant for keeping an eye on your budget and spotting any funny business straight away.

- Spending Insights: They often give you detailed breakdowns of where your money is going, which can be a real eye-opener and help you track your habits.

And don’t worry about safety – most of these app-only providers, like Starling, Chase, and Monzo, give you the full FSCS protection up to £85,000 per person. That’s exactly the same protection you get with the big traditional banks. Some, like Revolut, work a bit differently under e-money licenses, but they still have ways to keep your funds safe.

App-Only Account Interest Rates: Competitive or What?!

You’ll often find that app-only providers offer some seriously competitive interest rates. It really pays to shop around!

For instance, Chip is currently leading the pack with 4.51% on its instant access savings. Tandem isn’t far behind, offering 4.36% on its easy-access accounts and a rather tempting 5.85% if you’re happy to fix for one year. Zopa’s Smart Saver account is pretty decent too, at 4.03%, and you might even be able to boost that to 4.27% if you use their linked notice accounts. Then there’s Monument Bank offering 4.29% variable AER, and Atom Bank giving 3.95% on easy-access with an amazing 6.05% on one-year fixes!

Chase Bank does something quite clever – they offer 3% interest on their saver accounts but also give you a unique 5% on your round-up savings. This can be a really effective way to get a good return.

These rates are often miles better than what traditional banks offer, which can sometimes be as low as 0.39%, according to FDIC data. The main reason for this difference? These online-only banks don’t have the massive costs of running high street branches, so they can pass those savings on to us customers through better interest rates. It’s a win-win!

App-Only Account Access Rules: Getting Your Cash

App-only accounts usually let you move your money around between linked accounts almost instantly. Most transfers are done within about 20 minutes, though sometimes it might take up to a couple of hours. Providers generally give you a personal sort code and account number so you can make manual transfers if you need to, and many also use open banking, which means you can link your accounts and transfer money automatically.

How easy it is to withdraw your money can vary a bit. Monument Bank, for example, lets you take out up to £500,000 a day without any fuss. If you need more, you just have to go through a quick extra check. Halifax’s app-based account also lets you make as many withdrawals as you like without any charges.

The main trade-off is that there’s no in-branch service. And with some providers, if you close the current account that’s linked to your savings, you might find there are restrictions on how you can get your savings out. So, that’s something to keep in mind for the future.

App-Only Accounts: Who Are They Really For?

I think these accounts are absolutely brilliant for anyone who’s comfortable with tech and wants a convenient way to save with good returns. They’re particularly great if you:

- Are a digital native and happy managing all your finances on your smartphone.

- Care more about getting competitive interest rates than having an in-person bank branch.

- Like to keep a close eye on your budget and find spending insights and notifications helpful. This is as important for your savings as, say, using one of the best air fryers is for keeping your kitchen budget down!

- Are a regular saver who loves automated tools like round-ups that do the hard work for you.

- Want to set up an account quickly without needing to visit a bank.

I know a lot of people who use a kind of hybrid approach. They keep their traditional bank account for things like their salary and paying bills, but then they transfer their monthly spending money into an app-based account. This gives them much better control and visibility over their day-to-day spending. It’s a great way to test the waters if you’re curious about app banking but not quite ready to go all-in!

The simple user experience, combined with those market-leading rates, makes a really strong case for app-only accounts. They’re definitely one of those hidden gems in the UK savings world that the traditional banks don’t always tell you about.

Ethical and Green Savings Accounts: Save Money, Save the Planet!

Image Source: Sustainly

Beyond the usual savings options, I’ve found that ethical and green accounts offer a fantastic way to grow your money while also doing some good for the planet and society. These are the kinds of accounts that traditional banks rarely shout about, but I think they’re brilliant. They really do offer the perfect mix of growing your finances and making a positive impact.

Green Savings Features: What’s the Story?

So, what’s different about ethical or green savings accounts? Well, the main thing is that they use the money you deposit only to fund projects that have a positive environmental or social outcome. For example, Triodos Bank promises to lend savers’ money only to organisations that are making a positive difference to society and the environment. Similarly, Ecology Building Society uses your cash to finance things like energy-efficient homes, renewable energy developments, and sustainable community projects. It’s great knowing your savings are doing good!

What really sets these accounts apart is their investment policy. When you choose to save ethically, you can be sure your money will never be used to fund:

- Fossil fuel extraction or production.

- Mining companies.

- The arms trade.

- Deforestation, including in places like the Amazon.

Instead, your deposits will be busy supporting green initiatives. Think renewable energy (like wind and solar power), carbon capture projects, planting forests, and helping people make their homes more energy-efficient. I love that most providers are really open about where your money goes. Ecology Building Society, for instance, actively shows off the positive results of their lending through case studies. This kind of transparency is fantastic when you’re looking for a Savings Account UK that aligns with your values.

Green Savings Interest Rates: Can You Still Earn Well?

Now, you might be wondering if you have to sacrifice good interest rates to be ethical. Well, currently, ethical accounts offer some pretty competitive rates, although they might be just a tiny bit below the absolute market-leading standard accounts. Here’s a look at what I’ve found:

- NS&I Green Savings Bonds: Offering 4.20% AER (this is a three-year fixed account).

- Paragon Bank: They have a three-year fixed green savings account at 4.35% AER.

- Ecology Building Society: You can get 3.50% AER with their Cash ISA, or 3.45% AER with their 35-day notice account.

- Triodos Bank: Their easy access Online Saver Plus offers up to 2.80% AER/gross.

- Charity Bank: They offer a range, including an ethical 33-day notice account at 2.66% interest and an ethical one-year fixed-rate account offering 4.76% (though this one needs a £5,000 deposit).

While these rates might not always be the very top of the charts, they often beat the average for their specific type of account. For example, that NS&I 4.20% and Paragon’s 4.35% are both better than the average three-year fixed rate, which was around 4.01% AER recently.

Green Savings Access Rules: Getting to Your Money

How you can access your money varies quite a bit with ethical providers. NS&I’s Green Savings Bond, for instance, locks your money away for three years. You can invest between £100 and £100,000, but you won’t be able to get to it until the term ends. On the other hand, Ecology Building Society offers easy-access accounts where you can start with just £25.

If you’re looking for something in between, several providers offer notice accounts. Charity Bank has a 33-day notice account, but you need at least £5,000 to open it. Ecology offers a 35-day notice option that you can start with £500.

How you manage your account can differ too. Charity Bank accounts are mainly operated by post, though they have phone support. Tandem Bank, which also has a green ethos, offers app-only management for its ethical accounts.

Green Savings: Who Are They Best Suited For?

I think ethical savings accounts are particularly good for people who care about the impact their money has, as well as the financial return. They’re ideal if you:

- Want to know exactly how your money is being used.

- Are looking to make your savings align with your personal values.

- Are happy with potentially slightly lower rates than the absolute top market leaders, in exchange for ethical peace of mind.

- Would rather support green initiatives than industries that could be harmful.

If you’re new to ethical saving, you might want to start by looking at building societies like Nationwide or Leeds. Because of how they’re structured, they tend to be more ethical than traditional banks anyway, and they still offer competitive rates (Nationwide had a Flex Instant Saver at 3.00% variable for 12 months, and Leeds has offered good rates too). Making conscious choices about where your money goes can be as impactful as deciding which best dehumidifiers to buy to create a healthier home environment.

Ultimately, these accounts let your money do two jobs at once – earning you interest while also funding positive change. That makes them some of the best savings account options in the UK for anyone who’s socially conscious.

High-Interest Current Accounts: Everyday Banking That Pays!

Image Source: Barclays

Okay, so hidden away within our everyday banking services, there’s a surprising savings chance that not many people talk about. I’m talking about high-interest current accounts! These can offer pretty competitive returns while still letting you do all your daily banking. It’s like having a financial tool that does two jobs at once.

Current Account Features: More Than Just an Account

We all know current accounts are where our salary lands and our bills get paid from. They let us get cash out from ATMs, use our debit cards, and set up direct debits for all those regular payments.

Most standard current accounts don’t have monthly fees, which is great. Some premium ones do charge a bit each month, but they often come with extra perks like travel insurance or even higher interest rates. I’ve also seen packaged accounts that bundle in things like mobile phone insurance and breakdown cover for a monthly fee – sometimes these can be good value if you’d pay for those things separately anyway!

It’s interesting, though, that some accounts need you to pay in a minimum amount each month. Nationwide’s FlexDirect, for example, needs you to pay in at least £1,000 a month to get their interest. And it’s not just about paying money in; some accounts also make you set up a couple of direct debits from them too.

Current Account Interest Rates: Better Than You Think!

Believe it or not, the interest rates on some current accounts can actually be better than many traditional savings products! Nationwide’s FlexDirect offers a rather nice 5% AER (fixed) for the first 12 months on balances up to £1,500. If you keep that much in there for the whole year, you could earn up to £75. After the first year, the rate drops to 1% AER variable, so that’s something to keep an eye on.

But there are other competitive rates out there too:

- Kroo is offering an impressive 4.35% AER, and that’s on balances up to a whopping £500,000!

- Santander Edge Up gives you 3.50% AER on balances up to £25,000.

- Starling Bank pays 3.25% AER on balances up to £5,000.

One thing to remember is that most of these high-interest accounts will only pay the top rate on a certain amount of money. Anything you have in the account over that limit will probably earn much less interest, or even nothing at all. So, it’s not usually worth keeping loads of extra cash in them beyond that threshold.

Current Account Access Rules: Your Money, Your Way

Current accounts usually give you amazing flexibility compared to savings products. You can generally take money out whenever you want, with very few limits on how often or how much. How you manage your account can vary – some banks offer branch services, while others are app-only.

As I mentioned, many accounts need you to pay in a minimum amount each month to keep getting those interest benefits. For example, with Club Lloyds, they’ll waive their £3 monthly fee if you pay in at least £2,000 a month.

Overdrafts can be a useful safety net if you need one, but the interest rates on them are usually quite high, often around 39.9% APR. So, they’re best avoided if you can!

High-Interest Current Accounts: Who Are They Great For?

So, who really benefits from these high-interest current accounts? I’d say they’re particularly good if you:

- Usually keep a positive balance in your account.

- Can meet any minimum deposit requirements they have.

- Really value being able to get to your funds easily.

- Want to combine your everyday banking with earning some interest.

For the best results, I think a smart approach is to use these accounts up to the limit where they pay the best interest. Then, if you have more savings, you could move the extra cash into a different type of Savings Account UK option to make sure all your money is working as hard as possible for you. It’s all about creating a clever tiered system for your finances! Using your current account wisely can even play a part in helping you improve your credit score.

Notice Accounts: The Smart Middle Ground for Savers!

Image Source: The Times

I’ve found that notice accounts are a bit of an overlooked hero in the savings world. They kind of sit in the middle, offering higher interest rates than your bog-standard easy-access accounts, but with more flexibility than fixed-term deals where your money is locked away for ages. Honestly, they’re a pretty compelling compromise if you’re a savvy saver!

Notice Account Features: What Are They All About?

So, the main thing with these accounts is that you need to tell your provider before you want to take money out. This “notice period” is usually somewhere between 7 and 180 days. Most notice accounts will let you pay in as much money as you like, whenever you like. The minimum amount you need to open one can vary a lot though. Some providers will let you start with just £1, while others might want £10,000, or even £100,000 for certain accounts!

The big plus point with a notice Savings Account UK like this is that you can earn stronger interest rates without having to lock your cash away for years and years. And, unlike fixed-term accounts, there isn’t usually a set end date. Your money just keeps earning interest until you decide you want to take it out (after giving notice, of course).

Notice Account Interest Rates: Getting a Good Deal

Right now, notice accounts are offering some really competitive rates in the UK market. For example, a typical 95-day notice account from Charter Savings Bank can give you around 4.7%, which is often better than many fixed-term options. Kent Reliance has been offering about 4.66% for a 60-day notice period, and you can usually find 30-day notice accounts offering around 4.6%.

As a general rule, the longer the notice period you’re willing to accept, the higher the interest rate you’ll get. I saw that Aviva’s 32-day notice account was offering 4.5% AER, their 90-day option was at 4.4%, and their 120-day account gave 4.2%. So, it’s worth thinking about how quickly you might need your money.

Notice Account Access Rules: Planning Your Withdrawals

To get your hands on your money, you need to give your provider a withdrawal request and then wait for that agreed notice period to pass. Most banks and building societies will let you do this through your online banking, or sometimes by phone, email, or even by post. Once the notice period is over, the money will be transferred to your nominated bank account.

Some providers will let you take out part of your money, while others might make you withdraw the whole lot. And it’s worth checking if you can cancel a withdrawal request if you change your mind. Some accounts also give you the option to get your money out earlier without giving notice, but you’ll usually have to pay a penalty for this – typically, it means losing the interest you would have earned during the notice period.

Notice Accounts: Are They Right for You?

Given all these features, who are notice accounts really best for? I reckon they particularly suit people who:

- Want better rates than easy-access accounts but still need to get to their money eventually. Thinking about different account types is important, just like when you weigh up if Cash ISAs are a better fit.

- Are saving up for medium-term goals, like doing some home renovations, saving for a big holiday, or perhaps even a deposit for one of the best places to live in London.

- Can plan ahead when they’ll need to make withdrawals.

- Prefer having a bit more flexibility than you get with rigid fixed-term accounts.

These accounts really do strike a great balance between getting you competitive returns and giving you reasonable access to your cash.

Children’s Savings Accounts: Building a Bright Future!

Image Source: Greatest Gift

Among the financial products that don’t get enough attention, I think children’s savings accounts are amazing. They offer a really powerful way to start building some wealth for the younger generation, and at the same time, teach them some valuable lessons about money. It’s surprising how many parents overlook these special accounts, even though they have some brilliant benefits.

Children’s Account Features: What You Need to Know

Children’s savings accounts have some unique features designed just for young savers. Most banks will let you open an account right from when a baby is born. Usually, parents will manage the money until the child is about 7 or 8 years old. After that, many accounts let the children start managing their own money, with a bit of supervision from their parents, of course!

You usually only need a tiny amount to open these accounts – often just £1. Some accounts even offer little bonuses to get you started. I saw Halifax had a £10 opening incentive if parents opened an account for children under 15.

A really important feature is how tax-efficient these accounts can be. Firstly, children have their own Personal Allowance (that’s £12,570) and a Personal Savings Allowance of £1,000. This means that for most children, any interest they earn in their savings account is effectively tax-free. However, there’s something called the “£100 rule” that parents need to know about. If money that parents have gifted to their child earns over £100 in interest in a year, then all of that interest becomes taxable as the parent’s income. It’s a bit of a quirky rule, so worth keeping in mind! This is a type of Savings Account UK families should definitely know about.

Children’s Account Interest Rates: Often Better Than Adult Ones!

You’ll often find that children’s accounts offer even better interest rates than the ones for adults! Right now, HSBC’s MySavings account is leading the way with 5.00% AER on balances up to £3,000. Santander’s 123 Mini Current Account is another good one, giving 4.00% on balances up to £2,000. And Halifax’s Kids’ Monthly Saver offers an impressive 5.00% fixed for 12 months.

Children’s Account Access Rules: Getting to Their Money

How easy it is to get the money out can vary quite a bit from bank to bank. Easy-access accounts will let you take money out whenever you need to, which is ideal for teaching children about managing their money day-to-day. On the other hand, fixed-term accounts will lock the money away until the child reaches a certain age – commonly 16, 18, or sometimes even 21.

For regular saver accounts, like that Halifax Kids’ Monthly Saver I mentioned, you’ll need to pay in between £10 and £100 each month. With these, you usually can’t take money out early during the 12-month term.

Children’s Accounts: Who Are They Perfect For?

Above all, I think these accounts are absolutely perfect for parents, grandparents, or guardians who want to:

- Build a financial foundation for their children’s future. What a great head start!

- Teach practical money management skills from a young age. Maybe even use some of the savings for fun things to do in London with kids?

- Make the most of any gift money or pocket money the children receive by earning good interest on it.

- Prepare for big future expenses, like helping with university costs or buying their first car.

The mix of competitive interest rates and the chance to teach valuable life lessons makes these accounts a really essential, though often overlooked, part of good family financial planning.

Conclusion: Finding Your Perfect Savings Match!

Beyond those standard easy-access accounts, I’ve shown you that savvy savers now have access to these eight specialised options that most UK banks seem to deliberately keep quiet about. It’s true! Traditional financial institutions rarely advertise these accounts properly because, frankly, they offer significantly higher returns than their mainstream products. I mean, we’ve seen rates that can reach as high as 7.5% with Principality’s Regular Saver, which is miles better than the typical easy-access rates hovering around 5%.

Each of these hidden Savings Account UK types serves different needs and goals, which is why it’s so important to know about them. Lifetime ISAs are brilliant with that remarkable 25% government bonus if you’re buying your first home or planning for retirement. Then there’s Help to Save, delivering an unmatched 50% return for qualifying lower-income savers – what a boost!

Regular savers reward you for consistent monthly deposits with those lovely premium interest rates. App-only options give you digital convenience alongside competitive returns. Ethical accounts let you line up your values with your savings strategy, which I think is fantastic.

High-interest current accounts cleverly merge your daily banking with some impressive rates. Notice accounts strike that perfect balance between being able to access your money and getting good returns. And finally, children’s accounts are amazing for building wealth for the next generation while teaching them valuable lessons about money. Learning how to improve your credit score is about smart financial habits, and choosing the right savings account is a big part of that too!

Matching your specific financial goals with the right specialised Savings Account UK can make such an enormous difference to your money. If you’re saving for your first home, a Lifetime ISA is pretty much a no-brainer. If you’re a parent, you might find that children’s accounts offer rates that even beat most adult options!

But here’s a little warning: these exceptional rates probably won’t last forever. We’re expecting the Bank of England to cut interest rates, and when that happens, savings rates will likely drift downwards across all types of accounts. So, if you’re smart, you’ll look into locking in these hidden high-return options before the traditional banks quietly reduce their rates even further.

Your personal savings journey deserves more than just the standard options that most banks wave in your face. The perfect Savings Account UK for your goals probably does exist – the banks just sometimes prefer keeping these extra-good options hidden from plain sight!

Your Savings Questions Answered (FAQs)

Q1. What are some of the highest interest rates available for savings accounts in the UK?

Some of the best rates I’ve seen recently include Principality Building Society’s 7.5% AER on their regular saver account – that’s pretty amazing! First Direct also offers a 7% AER fixed for 12 months, and The Co-operative Bank has a 7% AER variable rate. Just remember, these top-tier accounts often come with rules about how much you can deposit and when you can withdraw, so always check the small print for your chosen Savings Account UK.

Q2. Are there any government-backed savings schemes with good returns?

Yes, there absolutely are! The Help to Save scheme is fantastic, offering a 50% government bonus on savings if you’re on a low income and eligible. And don’t forget Lifetime ISAs! They give you a 25% government bonus on your contributions, which is a massive help if you’re saving for your first home or for retirement. These are brilliant schemes.

Q3. How do app-only savings accounts compare to traditional bank accounts?

I find app-only savings accounts often have higher interest rates than traditional banks. This is mainly because they don’t have the costs of running high street branches. For example, Chip is currently offering a tasty 4.51% on instant access savings, and Tandem gives 4.36% on their easy-access accounts. Plus, these app-based accounts usually have really user-friendly interfaces and some clever tools to help you save more easily. They’re a great modern type of Savings Account UK.

Q4. What options are available for ethical or green savings?

There are several providers offering ethical savings accounts, which is brilliant if you want your money to do some good! These accounts invest in projects that are environmentally and socially responsible. For instance, places like Triodos Bank and Ecology Building Society offer competitive rates while making sure your money supports sustainable initiatives. NS&I also has Green Savings Bonds, which recently offered 4.20% AER for a three-year fixed term. It’s great to know your Savings Account UK can make a positive difference.

Q5. Are there any savings accounts specifically designed for children?

Yes, definitely! Many banks offer children’s savings accounts, and they often come with some really attractive features. HSBC’s MySavings account, for example, was offering 5.00% AER on balances up to £3,000. These accounts usually have very low minimum opening deposits, some tax advantages, and they’re a fantastic way to teach children about managing money from a young age. It’s a great way to start their journey with a Savings Account UK.