Did you know a massive five million people in the UK are “credit invisibles”? Honestly, that number is huge! Whether you’re one of them or just want to give your score a boost, learning how to improve your credit score is super important. It affects everything – from getting the best mortgage deal to sorting out a mobile phone contract.

A better credit score really opens doors. Think better chances for credit cards, loans, and mortgages, often with much nicer interest rates. Most people don’t realise how simple things can make a big difference. For example, just keeping the amount of credit you use below 30% of your limit can seriously improve how lenders see you.

I found out there’s more to boosting your credit score than just paying bills on time – although, trust me, that’s still vital! Banks don’t often shout about some really effective tricks, like using rent reporting services or handy Open Banking tools like Experian Boost.

Want to learn the proven ways to make your score shine? Brilliant! Let’s uncover those secrets and build a credit profile that lenders will absolutely love.

Understand What Really Affects Your Credit Score

Image Source: Bedel Financial

So, you think your credit score is just about paying bills on time? Let me tell you, there’s a bit more to it than that. Lenders actually dig quite deep when they check if you’re a good bet for credit. Let’s break down what they’re really looking at.

What lenders actually look for

Lots of people think there’s just one magic number deciding their financial fate. Nope! Lenders look at your money history to guess how you’ll handle credit in the future.

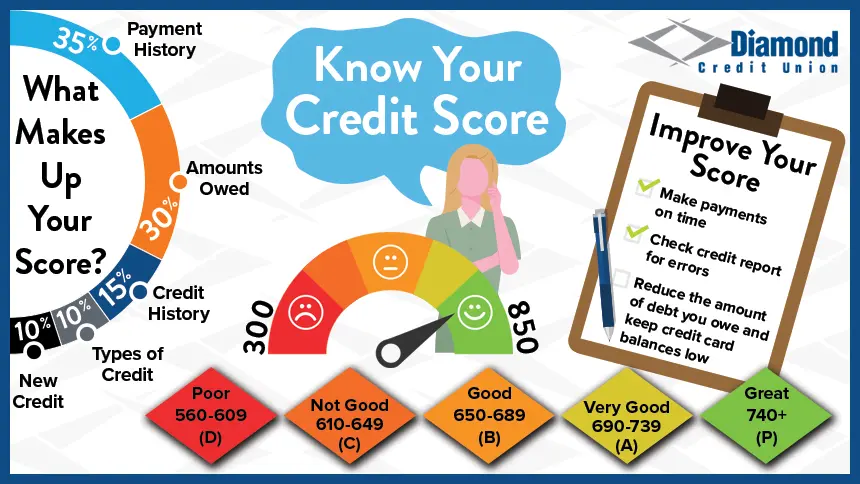

Your FICO score is a common one, and it focuses on five key things:

- Payment history (35%): This is the big one! Have you paid your accounts on time?

- Amounts owed (30%): How much credit are you using compared to your total limit?

- Length of credit history (15%): How long have your credit accounts been open?

- New credit (10%): Have you applied for lots of credit recently?

- Credit mix (10%): Do you have different types of credit (like cards, loans)?

Lenders pay close attention to your payment history because it shows if you’re reliable. Your credit utilization ratio also really matters – that’s the percentage of your available credit you’re using. Keeping this below 30% is a golden rule; it shows you manage credit well.

But wait, there’s more! Lenders look beyond your credit report too. They check things like your income, how stable your job is, and how long you’ve lived at your current address. Being on the electoral register helps loads because it confirms who you are and where you live. Maybe finding one of the best places to live in London and staying put could indirectly help here!

The role of credit reference agencies

Think of Credit Reference Agencies (CRAs) as the scorekeepers for your credit info. In the UK, the main three are Experian, Equifax, and TransUnion. Each one gathers details about your financial habits from different places.

They get info from public records (like court judgments or bankruptcy) and companies you have accounts with – banks, credit card providers, even energy suppliers. They track if you pay on time, your account balances, any financial links to other people, and public records.

Important bit: CRAs don’t decide if you get credit. As one CRA clearly states: “A CRA provides the data companies need – but it’s always the company that decides whether to accept or refuse your application”. They just supply the facts so lenders can work out the risk.

Here’s a catch: some lenders only report your information to one or two agencies, not all three. This is a big reason why your scores can look so different depending on where you check.

Why your score differs across platforms

Ever checked your credit score on different apps and thought, “Why are these numbers completely different?” It’s confusing, right? My scores look different everywhere I look!

There are a few reasons for this:

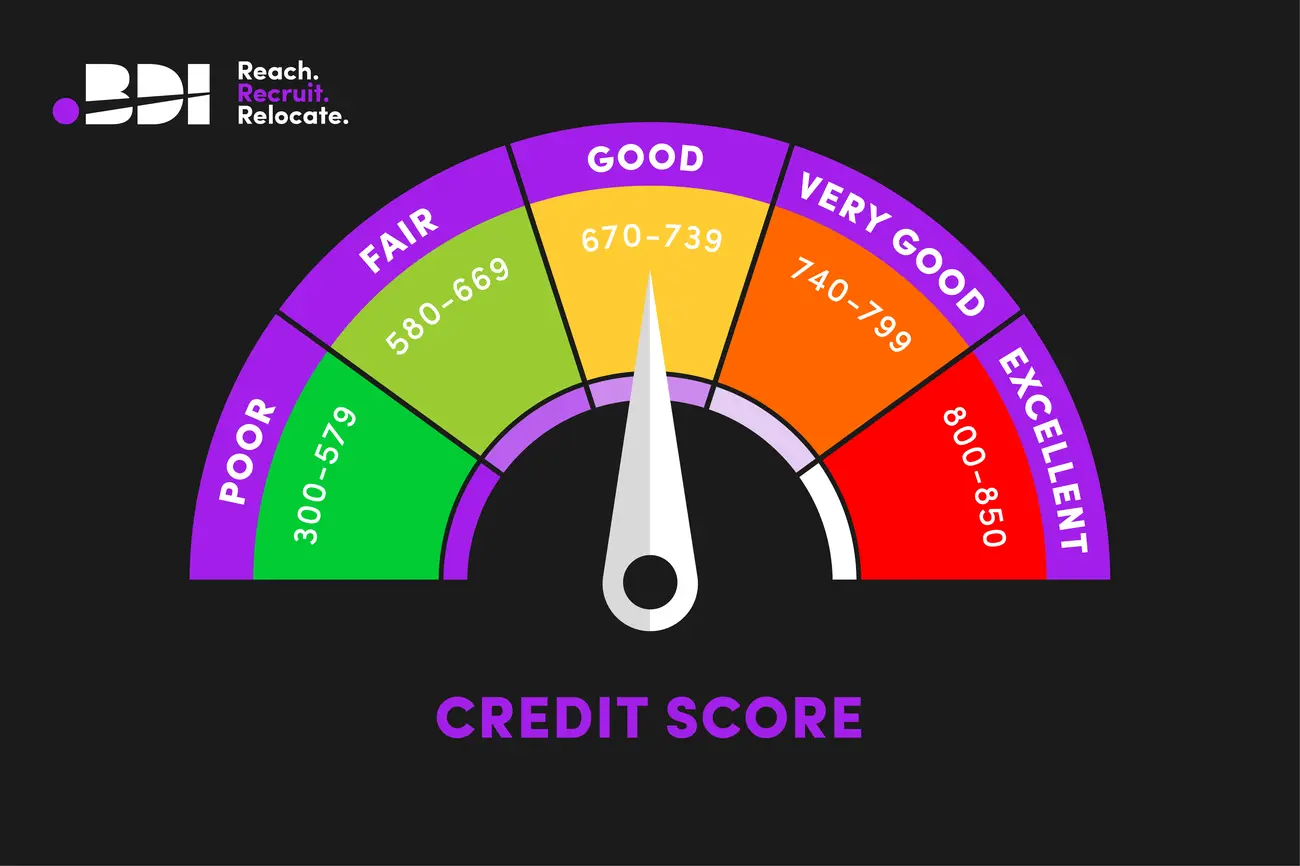

- Different Scales: Each CRA scores differently. Experian uses 0-999, Equifax uses 0-1000 (previously 0-700), and TransUnion uses 0-710. So, a “good” score number on one isn’t the same on another.

- Different Information: Like we said, lenders might not report to all three CRAs. Equifax puts it simply: “Some lenders also only report to one or two credit reporting agencies, which means your credit history could look different from agency to agency”. Your Experian report might miss something that’s on your TransUnion one.

- Timing Differences: Information isn’t updated instantly. It usually takes 4-6 weeks. Because lenders report at different times, a payment you just made might show up on one report before the others.

- Different Scoring Models: Even using the same info, the calculation method (the scoring model) can be different. Some models might care more about your credit utilisation, while others focus more heavily on how long you’ve had credit.

These differences show why you can’t just focus on one score. Getting a better credit rating means taking steps that improve your overall credit habits, which will eventually reflect positively across all agencies.

Quick Wins: How to Improve Your Credit Score Immediately

Image Source: Welch State Bank

Want to know how to improve your credit score quickly? Building great credit does take time, but guess what? There are some simple steps you can take right now that can make a difference sooner than you think. Let me show you three quick wins that could boost your creditworthiness in weeks, not months!

Register to vote at your current address

Honestly, this is probably the easiest win! Getting on the electoral roll can give your score a surprisingly big boost. Experian reckons this one simple action can add up to 50 points to your score with them. Amazing, right?

Why does it help so much? Lenders use the electoral register to check your name and address match up, which helps prevent fraud. As Experian explains: “When you register to vote, your electoral details are recorded on your report. This data helps lenders confirm your name and address, so your score will increase as a result”.

Don’t worry if you live in shared housing or with your parents – you can still register. The whole process takes about five minutes online at the GOV.UK website. Once done, your local council tells the credit agencies, though it usually takes a few weeks for it to show up on your report.

Just so you know, UK law says you have to register, even if you don’t plan to vote. If you’re not a UK citizen or can’t vote for other reasons, you should add a ‘notice of correction’ to your credit file explaining why you’re not on the register. This helps lenders understand your situation.

Fix errors on your credit report

You’d be shocked how many credit reports have mistakes! Around 25% of Americans find errors, and it’s likely similar here in the UK. These slip-ups, even tiny ones like a wrong address, can really drag your score down.

First step: get copies of your credit reports from all three main UK agencies (Experian, Equifax, and TransUnion). You can often check these for free online via their own sites or through comparison services. Keep an eye out for common errors like:

- Incorrect personal details (name spelled wrong, old address).

- Accounts listed that you don’t recognise (this could signal identity theft!).

- Accounts showing as ‘open’ when you’ve closed them.

- The same debt listed more than once.

- Incorrect payment information (e.g., showing a late payment when you paid on time).

Found a mistake? You need to challenge it with both the credit reference agency and the company that supplied the wrong information (like the bank or credit card company). When you raise a dispute, make sure you include:

- Your name and contact details.

- The reference number from your credit report (if you have it).

- Clear details of what the error is.

- Why you think it’s wrong.

- Copies of any proof you have (like bank statements or letters).

The credit agency has to investigate your claim and pass it on to the company involved. Most disputes get sorted within 30 days, but it can take up to 45 days if you send extra documents later. Your score might even change while they’re checking – if they agree something negative was wrong and remove it, your score could jump up quickly!

Pay off small debts or overdue bills

Paying your debts smartly can give your score a quick lift. Here’s where to focus:

- Late Payments: If you’ve missed any payments, get them paid ASAP. This stops any more negative marks hurting your score.

- Collection Accounts: Paying off debts that have gone to a collection agency can sometimes improve your score quickly. Even paying part of it can help, but paying it off completely is usually best.

- High-Interest Credit Cards: Got all your bills up to date? Brilliant! Now, focus on paying down the balances on your credit cards, especially those with high interest. This lowers your credit utilisation ratio (how much of your available credit you’re using), which is a big factor in your score.

Making payments on time, even just the minimum amount, shows lenders you can be trusted. Remember, your payment history is the most important part of your credit score!

If credit card debt is causing you stress, think about talking to a certified nonprofit credit counsellor. These experts are great – they can help you make a plan (often called a Debt Management Plan or DMP) to clear your debts, usually over three to five years.

Get these three things done – register to vote, check for errors, and pay down debt smartly – and you could see a real improvement in your credit score faster than you might expect. It’s a fantastic start on your journey of how to improve your credit score.

Smart Habits That Build Credit Over Time

Image Source: Diamond Credit Union

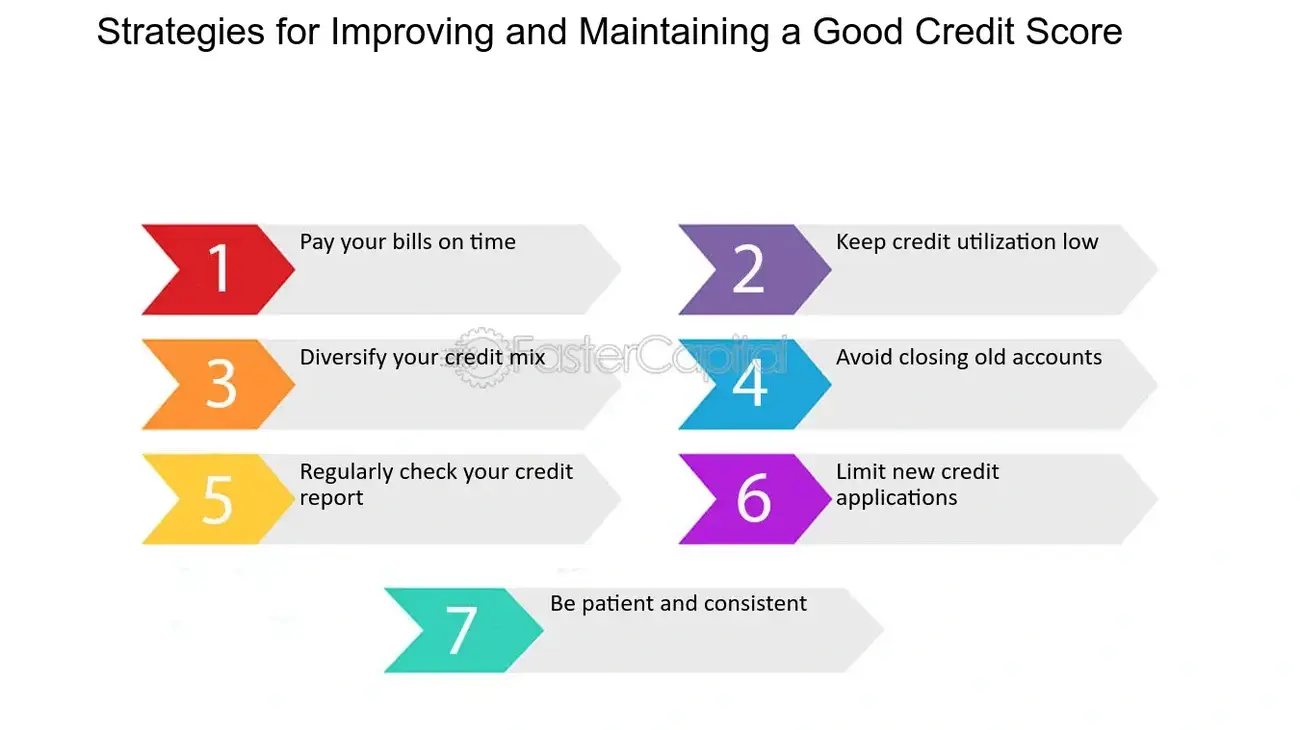

Building a truly excellent credit score takes more than just those quick fixes we talked about. Honestly, it’s about getting into good, steady money habits that show lenders they can rely on you. While the quick wins give you a boost, these long-term habits are key to how to improve your credit score month after month, year after year.

Always pay on time using direct debits

Did you know your payment history counts for a whopping 35% of your FICO score? That makes it the absolute most important thing lenders look at. Just one late payment can seriously knock your score down, especially if it goes unpaid for 30 days or more.

Setting up Direct Debits is, trust me, the easiest way to make sure you never miss a payment deadline. It takes away the risk of simply forgetting! Nearly all banks and companies offer automatic payment options linked straight to your bank account.

Here are a few simple tricks to help manage your payments:

- Pick one day each month (like the last Sunday) to check all your payments have gone out or are scheduled.

- Set up reminders on your phone or calendar as a backup – just in case!

- Make sure autopay is set up for at least the minimum payment due on things like credit cards or loans.

Remember, late payments can hang around on your credit report for up to seven years! It really shows that being consistent is more important than being perfect when you’re trying to build good credit.

Keep credit utilisation under 30%

Right, let’s talk about credit utilisation. This basically means how much of your available credit you’re actually using. It makes up about 30% of your credit score, so it’s pretty important!

Imagine you have a credit card with a £2,000 limit and you currently owe £1,000. Your utilisation is 50%.

Money experts usually say keep your overall credit utilisation below 30%. But honestly? Getting it into single digits (below 10%) is even better. People with the very best credit scores often use less than 10% of their available credit. Knowing how to manage this is a big part of how to improve your credit score.

Here’s how you can keep that utilisation nice and low:

- Try to pay down your credit card balances before your statement closing date (more on this below!).

- Think about asking for a higher credit limit on your cards (but only if you trust yourself not to spend more!). More available credit instantly lowers your utilisation percentage, assuming your balance stays the same.

- Consider making more than one payment towards your credit card bill during the month.

- Keep track of how much you’re spending across all your credit accounts. Getting into good saving habits, perhaps by looking into the best fixed rate ISAs, can free up cash to pay down balances faster.

Here’s a secret tip many people miss: credit card companies usually report your balance to the credit agencies around your statement closing date, not your payment due date. This means you could be using, say, 60% of your limit during the month, pay it off in full by the due date, but the credit agencies still see that higher 60% figure reported earlier! Paying before the statement date helps keep the reported balance low.

Avoid closing old accounts unnecessarily

How long you’ve had credit accounts open matters – it makes up 15% of your FICO score. Older accounts that you’ve managed well show lenders you’re stable and reliable over time. They’re valuable!

Closing an old credit card, especially your longest-held one, can cause two problems:

- It lowers the average age of all your credit accounts.

- It reduces your total available credit, which can push your credit utilisation percentage up.

Both of these can harm your score. Keeping those mature accounts open shows lenders you can handle credit responsibly long-term.

Worried about an annual fee on an old card you don’t use much, or tempted to overspend? You have options other than closing it:

- Ask the card provider if you can switch to a version with no annual fee.

- Keep the card active by putting a small, regular payment on it (like a streaming subscription) and paying it off in full each month via Direct Debit.

Trust me, keeping older accounts open and using them responsibly now and then is usually the best strategy for building that long, positive credit history that really helps improve your credit score.

Avoid These Common Mistakes That Hurt Your Score

Image Source: BDI Resourcing

It’s surprisingly easy to trip up and accidentally harm your credit score. Knowing the common pitfalls is just as important as knowing how to improve your credit score. Let’s look at the mistakes you really want to avoid.

Applying for too much credit too often

Every time you formally apply for credit (like a loan or credit card), it usually results in a ‘hard inquiry’ on your credit report. One or two aren’t a big deal, but making lots of applications close together can knock points off your score.

Why? Because scoring systems see lots of applications as a potential red flag – it might look like you’re desperate for credit or facing money troubles. A single application might only cause a small dip, but several in a short space of time can really add up.

And remember, even if your application gets rejected, the hard inquiry still gets recorded. Ouch! Here’s how to play it safe:

- Try to space out credit applications – maybe wait at least six months between applying for new cards.

- Avoid applying for new credit just before you plan to make a major purchase like a house or car, as you want your score to be as high as possible then.

- Only apply for credit when you genuinely need it, not just because an offer looks tempting.

Missing payments or going over limits

We’ve said it before, but it’s worth repeating: your payment history is the biggest factor affecting your score (around 35%). Missing even one payment can cause significant damage, especially if it’s over 30 days late. Plus, these missed payments can stay on your report for seven years!

Going over your credit limit (maxing out your card) is another big no-no. When you go over the limit:

- Your credit utilisation shoots over 100%, which looks really bad to lenders and hurts your score.

- You’ll likely get hit with penalty fees (which can be around £12, although rules vary).

- Your interest rate might even be increased.

Setting up Direct Debits is your best defence against accidentally missing payments. And make it a habit to check your balances regularly online or via banking apps to make sure you’re staying well below your limits.

Ignoring joint accounts with bad credit holders

Taking out a joint account (like a mortgage or loan) with someone links your credit files together. This means if you open an account with someone who has a poor credit history, lenders will see that connection when they check your file.

Crucially, both people on a joint account are equally responsible for the debt. If one person misses payments or racks up a huge balance, it will negatively affect both of your credit scores.

Even if the relationship ends, that financial link on your credit report can remain unless you actively remove it. If you’ve split up with a partner you had joint finances with, and you know they have poor credit, ask the credit reference agencies for a ‘notice of disassociation’. This breaks the link between your credit files.

Keep checking your own credit report regularly to make sure there aren’t any old financial associations dragging your score down unfairly.

Lesser-Known Strategies Banks Don’t Advertise

Image Source: FasterCapital

Okay, let’s talk about the clever tricks banks don’t usually tell you about! While the standard advice is important, there are some other great ways how to improve your credit score that aren’t widely promoted, often because they don’t directly make banks money. Combining these with the usual methods can give your credit profile a real edge.

Use rent reporting services to build history

Think about it – your rent is probably your biggest monthly outgoing, right? But usually, paying it doesn’t count towards your credit history. Crazy! Luckily, that’s changing. Services now exist that let you report your rent payments to the credit reference agencies.

Companies like CreditLadder, Canopy, and Loqbox Rent (formerly Flatfair is now part of Loqbox) can link to your bank account, see your rent going out, and report it. Some cost a small fee, but increasingly, landlords or property managers offer these services for free as part of your tenancy. Ask yours!

It usually takes about 60 days for these reported payments to start showing up and potentially helping your credit profile. This is a fantastic option if you’re just starting to build credit or if you’re rebuilding after hitting a rough patch.

Try Open Banking tools like Experian Boost

Open Banking is a relatively new thing that’s creating cool ways to show you’re responsible with money, even beyond traditional credit accounts. Experian Boost is a great example. It lets you securely connect your everyday bank account to your Experian credit file.

What does it do? It looks for regular payments you make that aren’t normally included in your credit report, like:

- Council tax payments

- Streaming subscriptions (like Netflix or Spotify)

- Savings accounts contributions (sometimes)

- Even some rent payments (though dedicated rent reporters are often better for this)

Experian uses this extra info to potentially give your score an instant lift. Many users see an immediate improvement! The best part? The basic Experian Boost service is completely free. Banks might not shout about it because it gives you more power and potentially helps you qualify for better deals elsewhere, but it’s a brilliant tool to know about for how to improve your credit score.

Add a Notice of Correction for special circumstances

Life happens, right? Sometimes things outside your control – like illness, losing your job, or other temporary setbacks – can negatively impact your credit history. If this has happened to you, a ‘Notice of Correction’ can help explain things to lenders.

This is basically a short statement (up to 200 words) that you write, explaining the situation behind any missed payments or difficulties. You send it to each credit reference agency (Experian, Equifax, TransUnion), and they legally have to add it to your credit report.

Whenever a lender then looks at your report, they’ll see your explanation. While the notice itself doesn’t automatically change your score, it gives important context that the computer algorithms might miss. It allows a human underwriter to understand the story behind the numbers.

This is your chance to explain temporary situations that don’t reflect your usual responsible approach to finances. It’s another underused tool that can make a real difference.

Using these lesser-known strategies alongside the main ones – paying on time, keeping utilisation low – gives you more ways to build a stronger credit profile, often faster than you’d expect.

How Long Does It Take to Improve Your Credit Score?

Image Source: Freepik

So, you’re eager to see that score climb? That’s great! But let me be honest – figuring out how to improve your credit score isn’t an overnight fix. It really does take a bit of time and patience. Knowing what to expect helps stop you from getting frustrated along the way.

Short-term vs long-term improvements

How quickly things change really depends on where you’re starting from and what steps you take. If you have a ‘thin’ credit file (not much history) or no credit history at all, you might see improvements within 3-6 months once you start building positive habits (like using a credit-builder card responsibly). Bouncing back from serious money problems, however, usually takes longer.

Some simple actions can bring quicker results:

- Getting on the electoral roll can take up to eight weeks to appear on your report and boost your score.

- Paying down high credit card balances might improve your score within 1-3 months as your utilisation drops.

- Closing a credit card account (which we generally don’t recommend for old accounts!) could impact your score for about 3 months.

Remember, credit reference agencies usually get updates from lenders every 30-45 days. So, after making positive changes, you’ll generally need to wait at least a month or so to see them reflected in your score.

How long negative marks stay on your report

Bad marks on your report don’t vanish instantly, but their impact does lessen over time. Still, lenders can see them for quite a while. In the UK, most negative information stays on your credit file for exactly six years from the date it was recorded. This includes:

- Late or missed payments

- Defaults (when you’ve broken a credit agreement)

- County Court Judgments (CCJs)

- Individual Voluntary Arrangements (IVAs)

- Bankruptcy

How long it takes to fully recover depends on how serious the issue was. FICO (a major scoring company) gives these rough recovery time estimates:

- Late mortgage payment: Around 9 months

- Missed payment/Default: Around 18 months

- Home foreclosure: Around 3 years

- Bankruptcy: 6 years or potentially longer

Experian puts it well: “Most of the information in your credit report is held for around six years, and companies often focus their credit scoring on more recent information”. The good news? Your credit health starts improving the moment you get back to good habits, even while those old marks are still visible. Consistency really is key!

Conclusion: Your Path to a Better Score

So, there you have it! Getting a strong credit score really comes down to taking some quick, smart actions and sticking to good habits over time. Simple steps like registering to vote or fixing errors on your report can give you a boost within weeks. But it’s those consistent habits – paying on time, keeping balances low – that truly shape how lenders see you in the long run. This journey of how to improve your credit score is definitely achievable!

Improving your score happens at different speeds for everyone, depending on your starting point. Quick wins might show results in a few months, which is fantastic motivation! Recovering from serious negative marks naturally takes longer, requiring patience and focus over several years. Remember those lesser-known strategies banks don’t shout about? Using things like rent reporting or Experian Boost can give you extra leverage alongside the traditional methods.

Ultimately, your credit score reflects how responsible you are with money – it’s not about how much you earn. Paying bills consistently, keeping credit utilisation low, and avoiding common mistakes are far more important than your salary. Start using these proven techniques today, stick with them, and you’ll see your credit score get stronger month by month. You’ve got this!

FAQs: Your Credit Score Questions Answered

Got a few more questions about how to improve your credit score? No problem! Here are quick answers to some common queries:

Q1. How quickly can I see improvements in my credit score?

You might start seeing positive changes within 3-6 months if you’re building good habits from scratch or have a thin file. Quick actions like registering to vote or paying down credit cards can show results in 1-3 months. But, recovering from serious issues like bankruptcy takes several years of consistent effort.

Q2. What’s the most important factor affecting my credit score?

Without a doubt, it’s your payment history. This makes up about 35% of typical scores (like FICO). Always paying your accounts on time is the absolute best thing you can do to keep your score healthy and improve it.

Q3. Does closing old credit card accounts help my credit score?

Usually, no – it can actually hurt it! Closing old accounts reduces the average age of your credit history and lowers your total available credit (which can increase your utilisation ratio). It’s generally much better to keep old, well-managed accounts open, even if you only use them occasionally.

Q4. How can I improve my credit score if I have no credit history?

Great question! Start with these steps:

- Get on the electoral roll.

- Consider a credit-builder credit card and use it responsibly (pay it off in full each month).

- Look into rent reporting services to add your rent payments to your history.

- Try tools like Experian Boost to link regular bill payments (like council tax or subscriptions) to your report.

Q5. What’s a good credit utilisation ratio to aim for?

Keeping your overall credit utilisation below 30% is the standard advice. However, aiming for single digits (below 10%) is even better if you can manage it. People with the very top credit scores usually use very little of their available credit limits. Managing this is a key part of knowing how to improve your credit score.