Honestly, is your Council Tax bill making your eyes water? With the cost of living still biting, keeping up with payments feels tougher than ever for so many of us across the UK.

But here’s some potentially brilliant news: if you’re struggling to afford your bill, help might be closer than you think! Did you know that loads of UK residents could be missing out on something called Council Tax Reduction – money off their bill that they’re actually entitled to?

This scheme, which you might also hear called Council Tax Support (CTS), isn’t cash in your pocket. Instead, it’s a discount applied straight onto your Council Tax bill, and it could slash what you owe quite significantly! It’s specifically designed to give a financial helping hand to people on low incomes. And the great thing is, it doesn’t matter if you own your home, rent, are working, unemployed, retired, or getting other benefits – you might still qualify.

Now, things changed back in April 2013 when Council Tax Reduction replaced the old Council Tax Benefit system. This means that while the scheme exists everywhere (except Northern Ireland, which has its own system ), the exact rules, especially for working-age people, are now mostly decided by your local council. This local control means the amount of discount and who exactly qualifies can be quite different depending on where you live.

So, what does qualify you for Council Tax Reduction? It’s ‘means-tested’, looking at your income and savings. For working-age folks, the savings limit is often under £16,000, sometimes even lower like £10,000 or £6,000 depending on your council, while for people of State Pension age, it’s usually up to £16,000 (unless you get Pension Credit Guarantee). What counts as ‘low income’ also varies based on your council’s specific rules.

I’ve put together this comprehensive guide to help you figure out if you might be eligible for Council Tax Reduction in 2025/26 and how to apply for it. You might even be surprised to learn you can apply up to 8 weeks before you need to start paying council tax, or that getting the Guarantee Credit part of Pension Credit could mean you pay no Council Tax at all!

What Exactly is Council Tax Reduction?

So, what actually is Council Tax Reduction (CTR)?

You might hear it called Council Tax Support (CTS) by some councils, but don’t worry – they usually mean the exact same thing!

Essentially, it’s a helping hand from your local council if you’re on a low income and finding it tough to pay your Council Tax bill.

Here are the key things I think you need to know about it:

- It’s a Discount, Not Cash: This is super important! If you qualify, you won’t get money paid into your bank account. Instead, your actual Council Tax bill will be reduced, meaning you owe less (or maybe even nothing!).

- It’s Aimed at Low Income Households: The whole point of Council Tax Reduction is to make Council Tax more affordable for people who don’t have a lot of money coming in.

- It Replaced the Old System: Back in April 2013, CTR took over from the old national Council Tax Benefit scheme. This change is why the rules can now vary locally.

Think of it as a discount voucher applied directly to your bill by the council, helping to ease that financial pressure.

Who Can Get Council Tax Reduction in 2025

Okay, this is the big question, right? Who actually qualifies for Council Tax Reduction?

Well, the good news is, as I mentioned earlier, you can potentially apply whether you own your home, rent, are working full-time, part-time, are unemployed, or retired. The main thing the council looks at is whether you’re on a low income.

But eligibility isn’t just about income. It depends on a mix of things, and honestly, the rules can feel a bit complicated because they differ across the UK, especially depending on your age.

The Basics: Core Eligibility Rules

Generally speaking, to even be considered for Council Tax Reduction, you usually need to meet these basic conditions:

- You’re Responsible for the Bill: You must be the person (or one of the people) legally responsible for paying the Council Tax for your home. Usually, this means your name is on the bill.

- It’s Your Main Home: The property you’re claiming for must be where you actually live – your main or sole residence.

- You’re on a Low Income: This is the key one! Your household income needs to be below a certain level set by your local council.

- You Meet Residency Rules: Generally, you need to have the right to live in the UK and not be subject to immigration rules that stop you from getting public funds.

If you tick these basic boxes, the next big factor is your age.

Working Age vs Pension Age Rules: This is Crucial!

This is probably the most important (and sometimes confusing!) part to understand. The UK has two different main systems for Council Tax Reduction:

- Pension Age Scheme: For people who have reached State Pension age.

- Working Age Scheme: For people below State Pension age.

You can easily check your State Pension age on the GOV.UK website if you’re unsure.

Why does this matter so much? Because the rules and the amount of help you can get can be very different!

Pension Age Scheme – What You Need to Know:

- National Rules: Generally, this scheme follows rules set by the UK government, so it’s pretty similar no matter which council area you live in.

- Often More Generous: People qualifying under the pension age rules can often get more help, potentially up to 100% off their Council Tax bill. Wow!

- Savings Limit (Capital): The standard limit for savings and investments (your ‘capital’) is usually £16,000.

- Pension Credit Link: Here’s a brilliant tip – if you receive the Guarantee Credit part of Pension Credit, that £16,000 savings limit often doesn’t apply, or a higher limit might be used! This means you could get full Council Tax Reduction even with savings over £16k.

Working Age Scheme – The Local Lottery:

- Local Council Rules: This is where it gets tricky. Since 2013, each local council designs and runs its own Council Tax Reduction scheme for working-age people. This means the rules can vary massively from one area to the next!

- Often Less Generous: Councils often set a maximum discount that’s less than 100% for working-age people. I’ve seen maximums like 75%, 80%, 85%, 90%, or 91.5% mentioned in different council policies. Some might offer up to 100%, but many don’t. This often means working-age residents have to pay something towards their Council Tax, even on a very low income.

- Savings Limit (Capital): This also varies wildly! While the government suggests £16,000, many councils set lower limits for their working-age schemes. You might find limits of £10,000 or even just £6,000. It is absolutely vital you check your own council’s specific rules.

What About Mixed-Age Couples? (One Pensioner, One Working Age)

This is where it can get really confusing, so listen up! If one of you is State Pension age and the other isn’t, the rules applied depend on a few things:

- Who Claims: It often makes sense for the pension-age partner to make the claim for Council Tax Reduction.

- Benefit Link: However, even if one of you is pension age, if either of you receives certain working-age benefits like Universal Credit (UC), income-based Jobseeker’s Allowance (JSA), income-related Employment and Support Allowance (ESA), or Income Support, your household will usually be assessed under the council’s working-age rules (which are often less generous).

- Getting it Right: Choosing the right person to claim can make a huge difference to how much support you get. If the pension-age partner doesn’t get those specific benefits, claiming in their name usually means you get assessed under the more favourable pension-age rules.

Quick Update for 2025: If you’re pension age and currently getting Tax Credits, you might be asked to move over to Pension Credit or Universal Credit as the Tax Credit system closes. The good news is, even if you move to Universal Credit, you should still be assessed for Council Tax Reduction under the pension-age rules.

Protected Groups: Some councils offer enhanced protection or higher reduction percentages for certain households under their working-age schemes, for example, if the household includes:

- Someone receiving disability benefits (like DLA or PIP)

- Someone receiving Carer’s Allowance

- A dependent child under a certain age (e.g., under 3 or 5)

- Someone in the ‘support group’ for ESA or with ‘limited capability for work’ under UC

- Someone receiving a War Disablement or War Widow’s/Widower’s Pension

Again, check your local council’s policy for details on protected groups.

Here’s a quick comparison table to help see the typical differences (but remember that working-age rules vary!):

| Feature | Working Age | Pension Age |

| Governing Rules | Set by Local Council (Varies significantly) | National Rules (Largely consistent across councils) |

| Max Potential Support | Often less than 100% (e.g., 75%-91.5%), but varies | Up to 100% |

| Typical Capital Limit | Varies by council (e.g., £6k, £10k, £16k) | £16,000 (unless receiving Pension Credit Guarantee) |

| Backdating Rules | Varies (e.g., 1-6 months); Requires ‘Good Cause’ | Up to 3 months automatically (if eligible) |

(Disclaimer: Working-age rules vary significantly between local councils. Always check your specific council’s scheme.)

Phew! That’s the main difference between the schemes. Understanding whether you fall under working-age or pension-age rules is the first big step to figuring out your potential Council Tax Reduction entitlement.

What Qualifies You for Council Tax Reduction? (The Means Test)

Alright, so you meet the basic rules and know whether you’re likely under the Working Age or Pension Age scheme. What next?

Well, Council Tax Reduction is ‘means-tested’. That basically means the council takes a really close look at your household’s financial situation to work out if you qualify for a discount, and if so, how much you should get.

Let’s break down what they look at:

How Councils Look at Your Money (Income & Savings)

This is obviously a huge part of the calculation. The council needs to understand what money you have coming in and what savings you hold.

Your Income: They’ll assess the income of your household, which usually includes:

- Earnings from Work: If you’re employed, they’ll look at your wages after tax, National Insurance, and sometimes half of your pension contributions are taken off (your net income).

- Self-Employed Earnings: If you work for yourself, they’ll look at your accounts. Be aware, some councils apply a ‘Minimum Income Floor’ for working-age claimants who’ve been self-employed for over a year. This means they might assume you earn the equivalent of minimum wage for a set number of hours (like 35 hours a week), even if you actually earned less.

- Certain Benefits: Things like contribution-based JSA/ESA or Carer’s Allowance might be counted (though some benefits are ignored – more on that below!).

- Tax Credits: If you still receive Working Tax Credit or Child Tax Credit.

- Pensions: Income from State Pension, occupational pensions, or private pensions.

- Your Partner’s Income: If you live with a partner, their income is always included in the calculation too.

Your Savings (Capital): Having savings, investments, or other ‘capital’ (like a second property you don’t live in) above the limit set by your council’s scheme usually means you won’t qualify.

- Pension Age Limit: Usually £16,000. But remember, if you get the Guarantee Credit part of Pension Credit, this limit might not apply!

- Working Age Limit: This VARIES HUGELY by council! It could be £16,000, £10,000, or even as low as £6,000. You absolutely must check your local council’s specific rules. Thinking about savings always makes me consider how important it is to make your money work hard – maybe exploring the Best Cash ISAs could be useful alongside managing your budget.

- Tariff Income (Pensioners): If you’re pension age and have savings between a lower limit (often £10,000) and the £16,000 upper limit, the council might add a bit of ‘assumed’ weekly income to your calculation based on those savings. It’s often £1 for every £500 (or part of £500) you have over the lower limit.

Income That Gets Ignored (Disregarded Income): Thankfully, councils don’t count every penny you receive! Certain types of income are usually disregarded, meaning they ignore them when working out your Council Tax Reduction. Common examples include:

- Disability Living Allowance (DLA)

- Personal Independence Payment (PIP)

- Attendance Allowance (AA)

- Child Benefit

- Child Maintenance payments you receive

- War Disablement Pensions and War Widow’s/Widower’s Pensions

Carer’s Allowance is often disregarded in full too, but it’s always worth checking your local council’s policy just in case. Some councils also have earnings disregards, where they ignore a small amount of your weekly wages (like the first £10 or £25).

Who Lives With You Matters (Household Circumstances)

It’s not just about money; your personal situation plays a big part too. The council considers:

- Your Age: (As we discussed with the Pension Age vs Working Age rules).

- If You Have a Partner: Your partner’s income and savings are included.

- Dependent Children: The number and ages of children living with you.

- Disability: Whether you, your partner, or any children have disabilities.

- Other Adults (‘Non-Dependants’): This is important! If other adults (who aren’t your partner or dependent children, like grown-up kids or other relatives) live with you, they are called non-dependants. The council usually assumes these adults should contribute towards the household bills, even if they don’t actually give you any money. So, they normally take a fixed amount off your potential Council Tax Reduction award based on the non-dependant’s gross income. The higher the non-dependant’s income, the bigger the deduction. However, these deductions might not apply if you or your partner get certain disability benefits (like the daily living part of PIP or care part of DLA), or if the non-dependant is a full-time student, in hospital long-term, or getting certain benefits themselves.

Benefits That Can Fast-Track Your Claim (‘Passporting’)

Some benefits act like a ‘passport’ to getting the maximum Council Tax Reduction available under your council’s scheme, especially for pensioners. If you or your partner get one of these, the council might not need to do such a detailed income calculation:

- Income Support (IS)

- Income-based Jobseeker’s Allowance (JSA(IB))

- Income-related Employment and Support Allowance (ESA(IR))

- Guarantee Credit part of Pension Credit (This usually means 100% CTR for pensioners!)

Important Note on Universal Credit (UC): While being on UC often means you have a low income and might be eligible for Council Tax Reduction, UC itself does not usually act as a passport in the same way. Your income and circumstances will likely still be assessed by the council even if you receive UC.

What Counts as ‘Low Income’? (Bands vs Tapers)

So, how low does your income need to be? Annoyingly, there isn’t one single answer across the UK! It depends on your council’s scheme and how they calculate things. There are two main methods they tend to use:

- Income Bands (Common for Working Age / UC): Many councils use set income bands. They calculate your net weekly or monthly income (after disregards). If your income falls into a certain band, you get a fixed percentage discount. For example, Band 1 (£0-£120/week) might get 90% off, Band 2 (£120-£180/week) gets 60% off, and so on.

- The Catch (‘Cliff Edge’): While bands can seem simple, especially if your income fluctuates (like on UC), they can create harsh ‘cliff edges’. Earning just £1 more per week could suddenly push you into a higher band, meaning your Council Tax Reduction drops significantly, potentially leaving you worse off overall than if you’d earned less!

- The Catch (‘Cliff Edge’): While bands can seem simple, especially if your income fluctuates (like on UC), they can create harsh ‘cliff edges’. Earning just £1 more per week could suddenly push you into a higher band, meaning your Council Tax Reduction drops significantly, potentially leaving you worse off overall than if you’d earned less!

- Applicable Amount & Tapers (Common for Pensioners / Some Working Age): Other councils (especially for pensioners not on Guarantee Credit) calculate your applicable amount. This is basically what the government thinks a household like yours needs to live on each week.

- If your assessed income is below your applicable amount, you usually get the maximum Council Tax Reduction allowed by the scheme.

- If your income is higher than your applicable amount, your maximum CTR is reduced gradually. This reduction is called a taper. A common taper rate is 20%. This means for every £1 your income is over your applicable amount, your weekly Council Tax Reduction is reduced by 20p.

- If your assessed income is below your applicable amount, you usually get the maximum Council Tax Reduction allowed by the scheme.

My Advice? Apply Anyway!

If you’re looking at all this and feeling confused about whether your income is low enough, my best advice is to make a claim anyway. The worst they can say is no! Many councils also have online benefit calculators on their websites which can give you a rough idea of what you might be entitled to. Managing finances can be tough, and understanding all the rules around benefits and bills is a key part of knowing how to improve your credit score and staying on top of things.

When and How to Apply for Council Tax Reduction

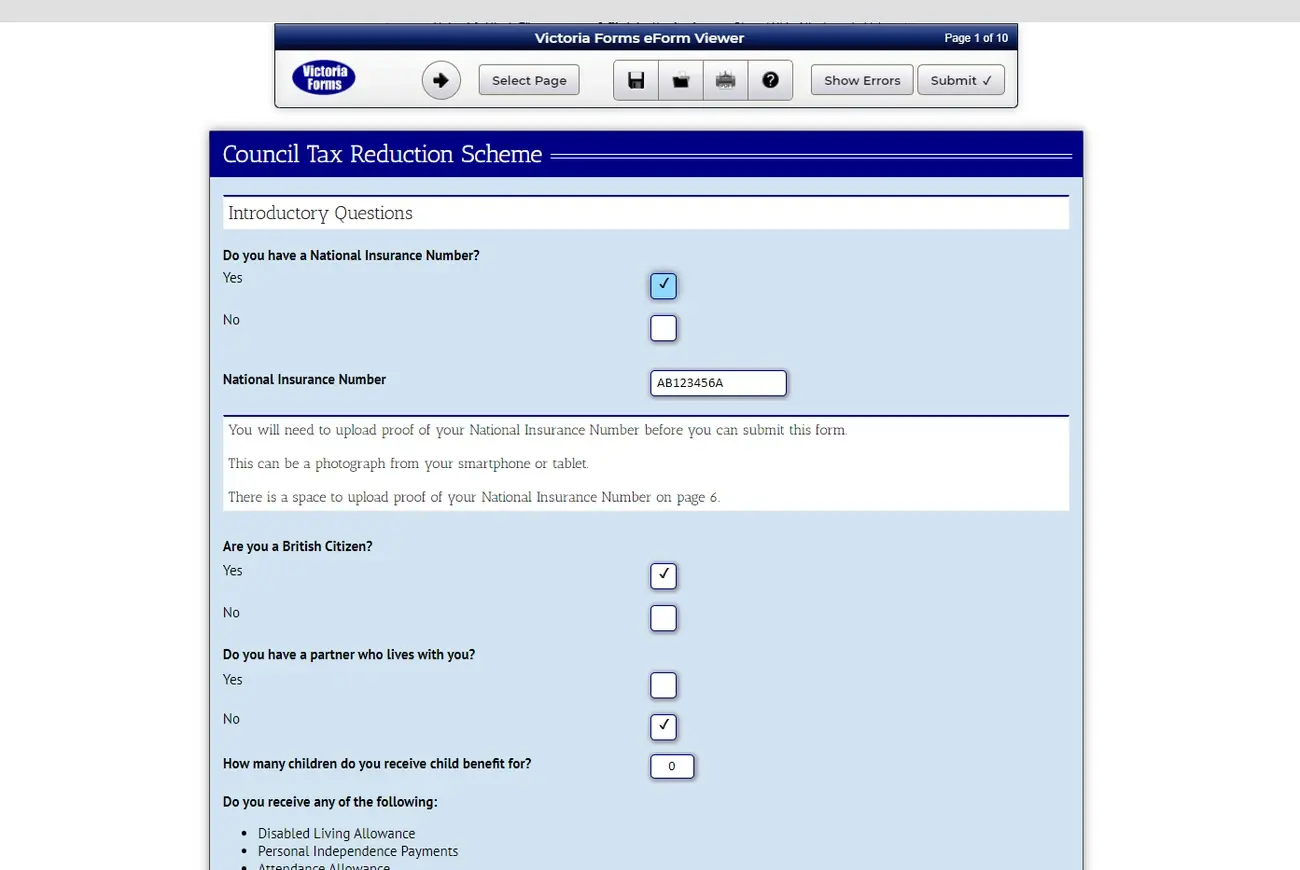

Image Source: Totaljobs

Applying for Council Tax Reduction (or Council Tax Support, remember they often mean the same thing!) involves going through your local council. Once you think you might qualify, the process itself is usually quite straightforward.

Getting Started: How to Apply

Here’s how you typically kick things off:

- Find Your Local Council: First things first, you need to know which council covers your address. The easiest way is usually to pop your postcode into the checker on the GOV.UK website.

- Check Their Process: Head over to your local council’s website. They’ll have a section explaining exactly how they want you to apply for Council Tax Reduction. Most councils prefer you to apply online these days, often through a special portal. They might also have forms you can download and print, or maybe even let you apply over the phone.

- Fill in the Form: Whether online or on paper, fill the application form in as accurately and completely as you can. If you live with a partner, usually only one of you needs to apply for the whole household.

Important Note for Universal Credit Claimants:

This bit is crucial! When you apply for Universal Credit (UC), the online form might ask if you also want help with your Council Tax. The DWP (Department for Work and Pensions) might then send some basic info to your council.

BUT… please, please do not assume this automatically counts as your application for Council Tax Reduction! Council processes vary wildly. Some might start looking into your CTR based on the UC info, but many others will still need you to make a completely separate application for Council Tax Reduction directly to them.

My strong advice? Contact your local council directly as soon as you’ve made your UC claim. Ask them point-blank if you need to fill in a separate Council Tax Reduction form. Relying only on the UC process could mean you lose out on money you’re entitled to, or face delays. Better safe than sorry!

Timing is Everything: When Should You Apply?

Don’t hang about! It’s always best to apply for Council Tax Reduction as soon as you think you might be eligible. Why? Because your discount usually only starts from the Monday after the council gets your application form. Waiting could mean missing out.

Even better, you can often apply before you actually become eligible:

- Moving House? You can apply up to 8 weeks before you become responsible for paying Council Tax at your new place (e.g., before you even move in!).

- Expecting a Change? If you know your circumstances are going to change (maybe you’re being made redundant or your income is dropping), you can apply in advance. For working-age folks, it’s usually up to 13 weeks early. For pension-age folks, it’s often up to 17 weeks early!

Applying early means you shouldn’t have such a long wait for the reduction to kick in once you are eligible.

Moving House – What To Do:

- Different Council Area: Tell your current council you’re moving out (and the date). Tell your new council you’re moving in (and the date). Your Council Tax Reduction from the old council will stop, so you must make a brand new application to the new council.

- Same Council Area: You still need to tell the Council Tax department you’ve moved address. Critically, you also need to tell the benefits team separately about your move so they can reassess your Council Tax Reduction based on your new situation (like your new rent, perhaps).

Life Changes? Tell the Council Immediately!

This is super important! You must tell your council’s benefits department straight away if anything changes that might affect your Council Tax Reduction award. You usually only have about 21 days or one month to report changes.

Things you normally need to report include:

- Starting or stopping work, or changing jobs.

- Changes in your or your partner’s earnings or other income.

- Starting or stopping getting other benefits (like JSA, ESA, IS, Tax Credits).

- Changes in your savings or capital.

- Changes in the income of any non-dependants living with you.

- People moving into or out of your home (including having a baby).

- Going into hospital or being away from home temporarily.

- Changes to your rent amount.

Why the urgency? If you don’t tell them quickly, you could end up being paid the wrong amount. If they pay you too much Council Tax Reduction (an overpayment), you’ll almost certainly have to pay it back. If they pay you too little, you’ll miss out on help you should have received!

Oops! Applied Late? Understanding Backdating

Don’t panic if you think you were eligible for Council Tax Reduction earlier but only just applied. Sometimes, your claim can be ‘backdated’ and paid from an earlier date. But the rules are quite different depending on your age group:

Pension Age Backdating:

- Easier Process: If the pension-age rules apply to your claim, it’s usually much simpler.

- Up to 3 Months: Your claim can normally be automatically backdated for up to 3 months before you applied, as long as you were eligible during that time.

- No Reason Needed: You generally don’t have to give a specific reason why you applied late.

Working Age Backdating:

- More Restrictive: This is tougher, and rules vary between councils.

- Shorter Period: The maximum backdating period allowed is often much shorter, frequently only 1 month. Some councils might allow longer (like 6 months), but check your local council’s policy.

- ‘Good Cause’ Needed: This is the key hurdle. To get any backdating under working-age rules, you must show you had continuous ‘good cause’ – a really good reason – for not applying earlier, covering the whole period you want backdated.

- What Counts as ‘Good Cause’? Things like:

- Being seriously ill or in hospital prevented you from applying.

- Dealing with a recent bereavement of a close family member.

- Being given wrong advice by an official body (like the council or DWP) that stopped you claiming.

- Having language difficulties or problems understanding the system.

- Being unable to manage your affairs (e.g., due to mental health) with no one to help you claim.

- What Usually Doesn’t Count: Simply not knowing Council Tax Reduction existed, or not realising you might qualify, is generally not accepted as ‘good cause’. The council expects you to take reasonable steps to find out about potential help.

- Evidence Required: You’ll usually need to provide proof to back up your reason (e.g., hospital letters).

- How to Request It: Look for a ‘backdating’ or ‘late claim’ section on the application form. If there isn’t one, write a separate signed letter explaining why you’re late and providing your ‘good cause’ reasons. You’ll also need proof of your income/savings for the backdated period.

Processing Times:

Once you’ve submitted your application (and any evidence), councils usually aim to process it and let you know their decision within about 10-35 working days, though it can sometimes take longer.

Getting Your Paperwork Ready: What You Need to Apply

Image Source: Victoria Forms

Right, gathering the correct documents and evidence is a really crucial step when you apply for Council Tax Reduction. Honestly, your local council can’t usually process your application properly without proof of your circumstances, so knowing what they need beforehand will speed things up and stop annoying delays.

The Key Documents and Evidence

While the exact list can vary slightly depending on your local council, most will generally ask you to provide proof of the following for you (and your partner, if you have one):

- Who You Are & Where You Live (Identity & Residence):

- Things like a valid Passport or Driving Licence.

- A recent utility bill (gas, electricity, water) in your name.

- Your birth certificate or marriage certificate.

- Your Council Tax bill itself!

- National Insurance (NI) Number:

- Your NI card (if you still have it!).

- Payslips often show it.

- Letters from the DWP (Department for Work and Pensions) or HMRC.

- Bank statements might show it if benefits are paid in.

- Money Coming In (Income):

- If Employed: Recent consecutive payslips – usually the last 5 if paid weekly, the last 3 if paid fortnightly, or the last 2 if paid monthly. Sometimes a certificate of earnings from your employer works too.

- If Self-Employed: Your recent business accounts, trading records, or tax returns.

- Benefits/Pensions: Copies of all pages of the award letters for any State Benefits (like Universal Credit – they often want the full breakdown), Tax Credits (if applicable), State Pension, or any work/private pensions you receive.

- If Employed: Recent consecutive payslips – usually the last 5 if paid weekly, the last 3 if paid fortnightly, or the last 2 if paid monthly. Sometimes a certificate of earnings from your employer works too.

- Savings & Investments (Capital):

- Recent bank, building society, or Post Office account statements. They usually want to see the last two full months for all accounts you hold (even ones that are overdrawn).

- Details of any other investments like Premium Bonds, shares, stocks, ISAs etc. Be upfront about everything. Finding ways to save effectively is key, and understanding your options like the Best Cash ISAs can be helpful when managing your finances.

- Recent bank, building society, or Post Office account statements. They usually want to see the last two full months for all accounts you hold (even ones that are overdrawn).

- Your Rent (If Applicable):

- Your formal Tenancy Agreement showing how much rent you pay and any service charges included.

- Your rent book or recent statements from your landlord or housing association.

Top Tip: Always double-check your specific local council’s website! They will have the definitive list of exactly what evidence they require for your Council Tax Reduction application.

What If You’re Missing Something? (Sending Documents Later)

Don’t let missing one or two documents stop you from getting your application form in! Remember, your claim usually only starts from when they receive the form. Here’s what to do:

- Submit the Form ASAP: Get the application form sent off straight away.

- Mark it Clearly: On the form (or in a covering note), write clearly which bits of evidence are missing and that you’ll send them soon (e.g., “Payslips to follow”).

- Send Evidence Promptly: Gather the missing documents as quickly as you can and send them to the council. They usually give you about one month from when you applied to get any outstanding evidence to them.

- Need More Time? If you’re struggling to get hold of something (maybe you’re ill or waiting for a statement), tell the council immediately. Don’t just ignore the deadline! Ask them if you can have an extension.

- How to Send It: Check how your council prefers to receive documents. Increasingly, they like electronic methods:

- Online Upload: Many have secure portals or forms on their website (check accepted file types like PDF/JPG).

- Email: Some accept emailed copies (make sure they are clear photos or scans).

- Photos: Clear smartphone photos are often fine.

- Post/In Person: Might still be an option, but check first. If posting valuable originals (like passports), use recorded delivery or see if they accept certified copies instead.

- Online Upload: Many have secure portals or forms on their website (check accepted file types like PDF/JPG).

- Label Everything! When sending documents separately, always include your full name, address, and your Council Tax account number or benefit claim reference number. This helps them match the evidence to your Council Tax Reduction application quickly.

Spotted a Mistake After Applying?

Made a typo or realised you put down the wrong figure after hitting ‘submit’? It happens!

The best thing to do is contact your council’s benefits department as soon as you realise. While you might be able to phone them, sending a quick email or letter is often better as it gives you a record. Just explain:

- Your name and reference number.

- What information on the form was wrong.

- What the correct information should be.

Being honest and correcting mistakes quickly helps make sure your Council Tax Reduction is calculated correctly and avoids potential problems later on.

Application Rejected or Need More Help? What Next?

Okay, so what happens if your application for Council Tax Reduction gets turned down, or you get less than you expected? Receiving that letter can be really disheartening, but it doesn’t necessarily have to be the final word. There are ways to challenge the decision or look for other types of support.

Challenging a Decision: Don’t Give Up!

If you think the council has made a mistake with your Council Tax Reduction claim, you have the right to ask them to look at it again. Here’s the process:

- Ask for an Explanation (Optional but Recommended): If you’re baffled by the decision letter, you can ask the council for a written explanation, sometimes called a ‘Statement of Reasons’. You usually need to ask for this within one month of the date on their decision letter. It helps you understand why they decided what they did.

- Request an Internal Review (Essential First Step): This is the crucial bit. If you disagree with the decision, you must first ask the council, in writing, to formally review it. This might be called asking for a ‘reconsideration’, ‘revision’, or lodging a ‘grievance’.

- Why: Clearly explain why you think their decision about your Council Tax Reduction is wrong (maybe they used the wrong income figure, or didn’t apply a rule correctly).

- Evidence: Include copies of any evidence that supports your argument.

- Deadline: Act fast! There’s usually a time limit to ask for this review – often one month (sometimes two) from the date of their original decision letter. Check your council’s specific timeframe.

- Why: Clearly explain why you think their decision about your Council Tax Reduction is wrong (maybe they used the wrong income figure, or didn’t apply a rule correctly).

- Wait for the Outcome: The council typically has two months to carry out the review and tell you their final decision in writing. You usually need to wait for this outcome before you can take things further. (Annoying, I know, but it gives them a chance to fix mistakes!).

Important: While the council is reviewing their decision, you should generally keep paying your Council Tax bill as originally requested to avoid falling into arrears.

Taking it Further: Appealing to an Independent Body

If you’ve been through the council’s internal review and you’re still not happy with their final decision (or if they didn’t even respond within their two-month deadline), you can then escalate your appeal to an independent body. Think of them as impartial referees.

- In England and Wales: You appeal to the Valuation Tribunal Service (VTS).

- In Scotland: You appeal to the Local Taxation Chamber (part of the Scottish Tribunals).

Here’s how that generally works:

- Deadlines:

- England/Wales: You normally have two months from the date of the council’s final review letter to appeal to the VTS. If the council didn’t reply to your review request within their two-month limit, you have four months from when you first asked for the review to appeal.

- Scotland: You usually have 42 days from the date of the council’s review decision to appeal to the Local Taxation Chamber.

- England/Wales: You normally have two months from the date of the council’s final review letter to appeal to the VTS. If the council didn’t reply to your review request within their two-month limit, you have four months from when you first asked for the review to appeal.

- Late Appeals: If you miss the deadline for a very good reason beyond your control (like serious illness), you might be able to ask for an extension, but you’ll need to explain why on the appeal form.

- How to Appeal: Use the official appeal form from the VTS or Local Taxation Chamber website (you can usually complete it online). You’ll need to attach a copy of the council’s final review decision letter.

- Cost: Appealing is free, but you’ll normally have to cover any expenses you have, like travel if hearings are in person (though many are virtual now).

- The Process: The tribunal will handle the paperwork, ask both you and the council for evidence, and schedule a hearing (this can take several months – the VTS estimates around 9 months currently!). You’ll get notice before the hearing. An impartial panel will listen to both sides and decide if the council applied its own Council Tax Reduction scheme rules correctly in your specific case.

- What Can Be Appealed: You can usually appeal decisions about whether you get CTR, the amount, the start/end dates, the figures used, or overpayments.

- What Can’t Be Appealed: You generally cannot appeal the council’s actual scheme rules (like their maximum discount percentage or savings limit for working-age people). The tribunal only checks if they followed their existing rules properly for you.

- Outcome: You’ll get a written decision. If you win, the council will be ordered to change its decision and recalculate your bill.

When You’re Still Struggling: Discretionary Reductions

What if you get the maximum Council Tax Reduction you’re entitled to under the normal scheme, but you’re still facing real financial difficulty paying the rest of the bill? There might be one more safety net.

- What is it? Councils have a special power (under Section 13A of the Local Government Finance Act 1992) to give extra, Discretionary Reductions in cases of exceptional financial hardship. They might call it an Exceptional Hardship Fund or Discretionary Relief.

- Who is it for? It’s designed for people facing severe difficulty who can’t afford their Council Tax even after all other discounts and the main Council Tax Reduction have been applied. It can sometimes help cover the shortfall, particularly in areas where working-age support doesn’t reach 100%.

- How to Apply: You need to apply directly to your council, usually with a separate application. You’ll have to clearly show you’re experiencing severe hardship. Be prepared to provide detailed evidence of all your income, expenses, debts, and explain your specific circumstances. Demonstrating hardship can sometimes go hand-in-hand with managing debt and improving your financial situation overall, which might be where tips on how to improve your credit score could also be relevant in the broader picture.

- Important Points:

- It’s discretionary – the council decides based on your situation and their policy; there’s no automatic right to get it.

- Funds are usually limited, so it’s often reserved for the most extreme cases.

- It’s often seen as short-term help.

If you’re finding the appeals process or applying for discretionary help confusing, organisations like Citizens Advice offer free, confidential support and can often help guide you.

Your Next Steps to Reducing Your Council Tax Bill

Wow, we’ve covered a lot of ground on Council Tax Reduction, haven’t we? Hopefully, you’re feeling much clearer now about how this vital support works and whether it could help you.

My biggest takeaway for you is this: Council Tax Reduction (or Support!) is a really important discount designed to help households on lower incomes manage their bills. It’s not cash, but money knocked directly off what you owe – and that can make a huge difference.

We’ve seen that who qualifies depends on your income, savings, who lives with you, and crucially, whether you fall under the national Pension Age rules (usually more generous) or the Working Age rules set by your local council (which can vary a lot!).

This is why I can’t stress this enough: your most important next step is to visit your own local council’s website. They are the only ones who can give you the definitive, up-to-date information about their specific Council Tax Reduction scheme – the exact income levels, savings limits, maximum support they offer, and exactly how to apply in your area. If you’re not sure who your council is, just use the postcode finder on GOV.UK.

Remember to apply as soon as you think you might be eligible, get your evidence ready, and always, always tell the council immediately if your circumstances change. And don’t forget, if things don’t go to plan, you do have the right to ask them to look again and potentially appeal, or even ask about extra discretionary help if you’re facing exceptional hardship.

I really encourage everyone who thinks they might qualify for Council Tax Reduction to look into it further and put in an application. This support exists specifically to help ease the financial pressure – you might be genuinely surprised to find you’re eligible for a significant saving on your Council Tax bill for 2025 and beyond! Taking control of your finances, even exploring potential benefits like Council Tax Reduction, is a positive step.

If you need more help understanding it all, organisations like Citizens Advice, Age UK (especially for older people), and Turn2us offer fantastic free, independent advice.

Good luck – I hope you manage to reduce that bill!

Council Tax Reduction: Your Questions Answered (FAQs)

Got a few more questions buzzing around about Council Tax Reduction? No worries, I’ve put together answers to some common queries!

Q1. Is Council Tax Reduction the same as Council Tax Support?

Yes, usually! Different councils might use different names – Council Tax Reduction (CTR) or Council Tax Support (CTS) – but they generally mean the same scheme designed to help people on low incomes pay their Council Tax bill.

Q2. Can I get Council Tax Reduction if I’m working?

Absolutely! You don’t have to be unemployed. Council Tax Reduction is available to people who are working (full-time or part-time) but have a low household income. It’s also for those who are unemployed, retired, or receiving certain other benefits.

Q3. What are the savings limits for Council Tax Reduction?

Ah, this depends on your age and critically, your local council’s rules, especially if you’re working age!

- Pension Age: The standard limit is usually £16,000 in savings and capital. BUT, if you get the Guarantee Credit part of Pension Credit, this limit often doesn’t apply!

- Working Age: This VARIES A LOT between councils! Some use £16,000, but many have lower limits like £10,000 or even £6,000. You must check your specific local council’s working-age scheme rules for their exact capital limit for Council Tax Reduction.

Q4. Do I need to apply separately for Council Tax Reduction if I claim Universal Credit (UC)?

My strong advice is YES, check directly with your council. While the UC application might ask about help with Council Tax, and the DWP might pass some info on, it doesn’t always trigger a Council Tax Reduction claim automatically. Some councils absolutely require a separate application form. Don’t risk missing out – confirm with your council!

Q5. How do I actually apply for Council Tax Reduction?

First, find your local council (use the GOV.UK postcode checker). Then, visit their website. Most councils prefer you to apply online. You might also find downloadable paper forms or, occasionally, be able to apply by phone. You’ll need to provide proof of your identity, income, savings, etc.

Q6. What can I do if my Council Tax Reduction application is rejected?

Don’t just accept it if you think it’s wrong! First, ask your council in writing for an internal review (sometimes called a reconsideration) within one month. If you’re still unhappy after their review, you can then appeal to an independent body – the Valuation Tribunal Service (in England/Wales) or the Local Taxation Chamber (in Scotland).

Q7. What if I get Council Tax Reduction but still can’t afford my bill?

If you’re facing severe financial difficulty even after receiving the maximum Council Tax Reduction you’re entitled to, you can ask your council about a Discretionary Reduction (sometimes called an Exceptional Hardship Payment). This is extra help they can give in exceptional circumstances, but it’s not guaranteed as funds are limited and it’s entirely at their discretion. You’ll need to provide detailed evidence of your hardship.