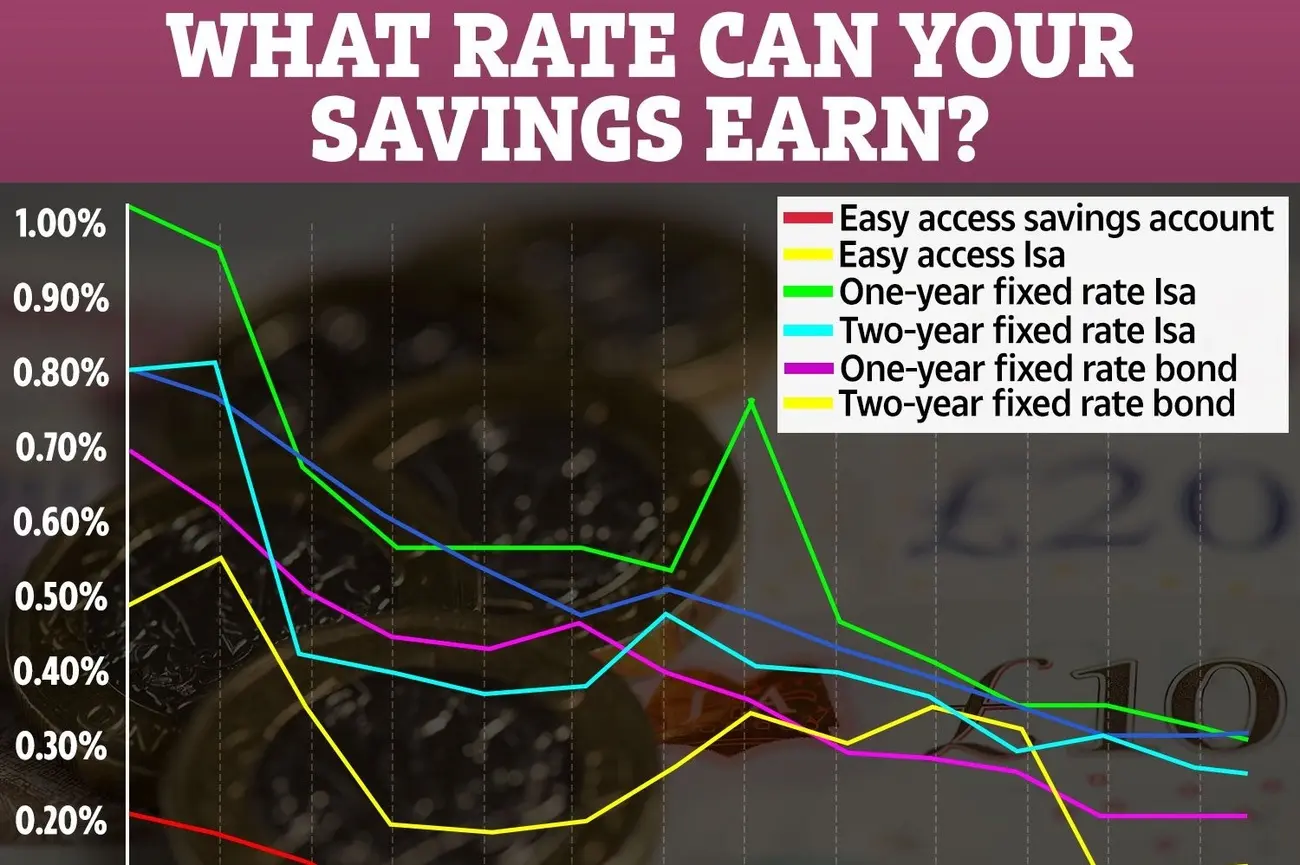

You know what? When you look at typical UK savings accounts right now, they often don’t look quite as shiny compared to the Best Cash ISAs. Honestly, these tax-free accounts are offering some fantastic interest rates, although I get the feeling this golden opportunity might not last forever!

The maximum amount you can stash away in ISAs for the 2025/26 tax year is still £20,000. Now, there’s been some chatter and official documents flagging potential future changes, as the government has frozen the allowance until 2030 and might look at ways to encourage Stocks and Shares ISAs more. Nothing’s set in stone yet, but it does make finding the Best Cash ISAs right now feel even more important if you want to make the most of that tax-free saving potential. Good financial habits are key, and knowing how to improve your credit score goes hand-in-hand with smart saving.

I’ve spent ages digging into the market, and let me tell you, there are some real winners out there. Moneybox is grabbing headlines with a cracking 5.71% AER variable rate, though that includes a bonus for the first three months. Plum has also been offering tempting rates, recently hitting 5.68% AER variable for new savers (again, with a bonus period). Trading 212 has a solid standard rate of 4.5% AER variable but often boosts this with brilliant promotions – I’ve seen exclusive deals offering as high as 5.07%! And Tembo offers a straightforward 4.8% AER variable without any bonus fuss.

Fixed-rate cash ISAs are another great way to go if you can lock your money away. Gatehouse Bank is offering a competitive 4.35% AER for a one-year term. Zopa isn’t far behind with 4.40% AER fixed for one year. Santander’s one-year fixed rate is currently lower at 3.60% AER. Just remember, dipping into fixed-rate accounts early usually means you’ll face a penalty, often equivalent to several months’ interest – Santander, for instance, charges 120 days’ worth.

This guide dives into the 12 Best Cash ISAs I could find for 2025. I’ll compare the rates, the rules, and any special features to help you choose the right home for your tax-free savings before any potential allowance changes shake things up.

Trading 212 Cash ISA: The Digital Challenger

Image Source: Trading 212

Trading 212 really makes a splash in the cash ISA pool with its competitive rates and slick, digital-first approach. If you’re looking to save somewhere beyond the traditional high street banks, I think you’ll find this platform pretty appealing.

Trading 212 Rate: How Much Can You Earn?

The standard interest rate you’ll get with Trading 212 is a respectable 4.5% AER variable on your pounds. But here’s the exciting bit – they often run special promotions with even better rates. For example, I’ve seen exclusive deals pop up offering a guaranteed 5.07% AER for the first 12 months, which is fantastic! It’s always worth keeping an eye out for these deals when you sign up.

One thing I really like is that Trading 212 calculates and pays your interest daily, not monthly or yearly like many others. It feels good seeing those pennies add up each day!

Flexibility and Access: Managing Your Money

Trading 212 offers a flexible ISA. What does that mean? Well, you can take money out and put it back in within the same tax year (that’s 6th April to 5th April) without messing up your £20,000 annual allowance. This gives you way more freedom than you get with fixed-rate accounts.

You manage everything through Trading 212’s super user-friendly app – you can get started with just £1! Just be aware:

- It’s 100% digital, so there are no branches or phone support lines.

- Your money is fully FSCS protected up to £85,000.

- They keep your cash safe in major banks using ring-fenced accounts.

- You can withdraw your money whenever you need it without facing penalties.

Moving Your ISA: Transfer Options

Got an ISA somewhere else? Moving it over to Trading 212 looks really simple using the app. You can transfer both cash and investments from other providers. If you’re moving investments, they can often do it “in specie,” meaning they move the actual investments without you having to sell them first.

Trading 212 doesn’t charge any fees for bringing ISAs in or sending them out if you decide to leave later. Just double-check if your current provider charges any exit fees – you don’t want any nasty surprises!

Brilliantly, transferring ISAs from previous tax years doesn’t use up any of your current £20,000 allowance. So, you can consolidate old ISAs here and still save your full whack for this year.

Moneybox Cash ISA: Top Rate with Conditions

Image Source: Moneybox

Moneybox is currently leading the pack for the Best Cash ISAs with its headline-grabbing interest rate and easy app-based management. This digital provider offers savers a fantastic chance to grow their money tax-free, as long as you can stick to a couple of rules.

Moneybox Rate: Understanding the 5.71% AER

Okay, let’s break down that impressive 5.71% AER variable rate. It’s definitely one of the highest out there right now! But, it includes a 1.51% bonus AER that only lasts for the first three months. After that, the rate drops to a still decent 4.20% AER variable.

To get (and keep) that top rate, you need to meet two simple conditions:

- Keep your balance at £500 or more.

- Make no more than three withdrawals in any 12-month period (starting from when you opened the account).

Slip up on either of these – let your balance dip below £500 or make that fourth withdrawal – and your interest rate plummets to just 0.75% AER variable for the rest of your account year. Ouch! If this happens during your first three months, you’ll lose the bonus part too.

Trust me, meeting these conditions really matters. It’s a fantastic rate if you can keep a steady balance and don’t plan on dipping into your savings too often.

Withdrawal Rules: What You Need to Know

As I mentioned, you’re allowed three withdrawals each year without it affecting your interest rate. Your count resets every year on the anniversary of opening your account.

Make that fourth withdrawal, and boom – the rate drops instantly to 0.75% until your next anniversary.

It’s also important to know this isn’t a ‘flexible’ ISA like the Trading 212 one. If you take money out, you can’t put it back in during the same tax year without that deposit counting towards your £20,000 ISA allowance.

App Experience: Managing Your Savings

Everything is managed through the Moneybox app (which has won awards!) or their website. Setting up is super quick – download the app, sign up, and pop in your first £500 (which you need for the top rate anyway).

The app offers handy ways to save:

- Set up weekly deposits.

- Add money on payday.

- Make one-off top-ups whenever you like.

With this specific Cash ISA, your interest is calculated daily and paid into your account on the first day of each month. This is different from their ‘Open Access Cash ISA’, where interest is paid annually.

Speaking of which, if you want fewer restrictions, Moneybox also offers that Open Access Cash ISA. It currently pays 5.05% AER variable (including a 1.05% bonus for 12 months) but allows unlimited withdrawals, although you still need to keep the £500 minimum balance to get that rate.

Tembo Cash ISA: Simple Rate, Solid Protection

Image Source: Tembo

Tembo really makes a name for itself as one of the Best Cash ISAs for 2025. I like their straightforward digital approach which comes with steady rates and absolutely no hidden penalties.

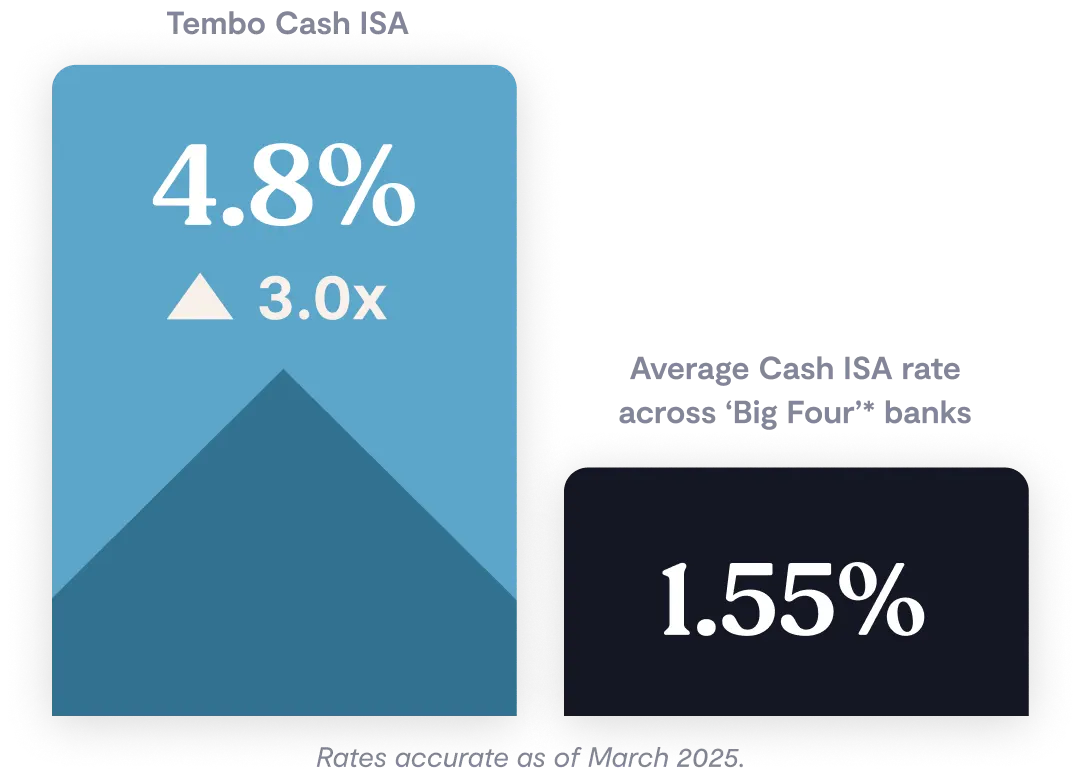

Tembo Rate: Steady 4.8% AER Explained

With Tembo’s Cash ISA, you get a competitive 4.8% AER variable interest rate. That might not sound wildly different, but compared to the easy-access Cash ISAs from the big high street banks, Tembo reckons this rate could give you over £500 extra interest over five years!

What I appreciate is that Tembo doesn’t mess around with short-term bonus rates to lure you in. The rate you see is the rate you get, and it won’t suddenly drop off after 12 months. Plus, your rate isn’t affected if you need to make withdrawals or if your balance dips. Interest is calculated daily and pops into your account every month, so you can actually see your savings growing.

It follows all the standard ISA rules, so you can deposit up to the £20,000 allowance in the 2025/2026 tax year. Tembo also promises to give you a day’s notice if they ever need to change the rate.

Access and Deposits: Easy Does It

Getting started is really easy – you only need a minimum deposit of £10. This makes it accessible for almost everyone. The main requirements are simple:

- You need to be at least 18 years old.

- You must be a UK resident for tax purposes.

- You’ll need your National Insurance number.

Everything is handled smoothly through Tembo’s mobile app. And here’s a big plus – you can make as many withdrawals as you need without facing penalties. Tembo usually gets the money back to your linked account the same day if you request it before 2 pm on a working day, although sometimes transfers can take up to 3 business days.

The minimum you can take out is £10 (unless your balance is less than that). Just keep in mind, Tembo’s ISA isn’t ‘flexible’. So, any money you withdraw can’t be put back in during the same tax year without it using up more of your £20,000 allowance.

Safety First: FSCS Protection via Partners

Your money isn’t actually held by Tembo itself. Instead, they place it in secure client money accounts with established banking partners like Barclays and Bank of Scotland. This is great news for safety, as it means your savings benefit from Financial Services Compensation Scheme (FSCS) protection.

The FSCS protects up to £85,000 of your money per eligible person, per banking institution. Because Tembo uses several partner banks, your total protection could potentially stretch well beyond £85,000 if your funds are spread across these different banks. This smart setup helps manage risk, especially if you have larger sums to save. Even if Tembo were to stop trading, your money remains safe with the partner banks under the FSCS umbrella.

Plum Cash ISA: Bonus Rate with Important Caveats

Image Source: The Plum Blog

Plum’s app-based Cash ISA certainly catches the eye with attractive headline rates. However, I think it’s really important for savers to dive into the small print and understand the conditions attached.

Plum Rate: Breaking Down the Bonus

Plum’s Cash ISA rate does jump around quite a bit! Recently, rates like 4.92% AER variable have been advertised, often including a bonus element (like 0.88% AER variable) that lasts for the first 12 months. It’s crucial to check the exact rate and bonus structure when you apply.

Importantly, this top rate usually only applies to new money you deposit after opening the account. If you’re transferring in an existing ISA from another provider, you’ll likely get a lower underlying rate – currently around 3.54% AER variable. The bonus part of the interest, if applicable, is calculated daily but often only paid out on your account’s anniversary.

Another key condition: you need to keep at least £100 in the account at all times. If your balance drops below £100, the interest rate will fall significantly, down to around 2.50% AER variable.

Withdrawal Penalties: Know the Rules

While Plum markets this as an easy-access account, the withdrawal rules are quite strict if you want to keep the best rate:

- Make four or more withdrawals within your 12-month bonus period, and your rate will drop to that lower 2.50% AER variable level.

- Withdraw money mid-month, and you might lose the interest earned for that entire month.

- Close your account mid-month, and you could forfeit the interest accrued for that month too.

Like Tembo’s, this ISA isn’t flexible. You can’t replace withdrawn money within the same tax year without it hitting your annual ISA allowance. Interest is calculated daily, but it typically lands in your account on the last business day of the following month.

Long-Term Value: Is Plum Right for You?

After the first year’s bonus period ends, the interest rate drops to Plum’s standard underlying rate, which is currently around 3.54% AER variable. If you’re looking for consistently good returns over the longer term, you might find better options elsewhere. For example, Tembo’s 4.8% AER variable rate doesn’t have that 12-month drop-off.

On the plus side, your deposits are FSCS protected up to £85,000, and managing the account via Plum’s app is straightforward with no direct charges.

So, who is this Plum Cash ISA best for? I’d say it suits disciplined savers who are confident they can keep the balance above £100, won’t need to make many withdrawals (fewer than four a year), and are perhaps prepared to look for one of the Best Cash ISAs elsewhere once the initial bonus period finishes.

Leeds Building Society Cash ISA: Traditional Service, Modern Options

Image Source: Leeds Building Society

Leeds Building Society offers a nice blend – the reassurance of traditional branch-based service combined with handy digital options. I think this approach makes them a really appealing choice, especially for savers who like having the option of face-to-face help.

Leeds Rates: Variety and Reputation

Leeds Building Society has several competitive cash ISA options available. Looking at their current range (as of April 2025):

- Their Online Access ISA offers a 4.41% tax-free variable rate, with the term running until June 2, 2027. You’ll need £1,000 to open this one.

- The 1 Year Double Access Cash ISA gives you 4.35% tax-free variable, again needing £1,000 to start, but has limits on withdrawals.

- Their 1 Year Fixed Rate Cash ISA provides a 3.80% tax-free fixed rate until June 1, 2026, and you can open this with just £100.

It’s worth remembering that Leeds Building Society has a long history (some customers remember it as Leeds and Holbeck!). Customer reviews often praise their staff for being “friendly,” “professional,” and “personable”. That personal touch can make a real difference.

Access and Terms: What to Expect

The minimum amount you need to open an account varies. As we saw, the fixed-rate ISAs often start from £100, while the variable-rate access accounts usually need £1,000. Be careful though – if your balance drops below these minimums, the interest rate can plummet to just 0.05%!

Withdrawal rules also differ between products. The Online Access ISA allows unlimited withdrawals. The Double Access Cash ISA typically lets you make two withdrawals per year before a penalty kicks in (often around 30 days’ interest). With the fixed-rate options, expect to lose around 90 days’ worth of interest if you need to take your money out early.

Ideal for Conservative Savers?

I think Leeds Building Society holds strong appeal for more cautious savers. Why?

- Having physical branch locations means you can get face-to-face guidance when opening or managing your account.

- Your money is safe with FSCS protection covering deposits up to £85,000.

- Their products tend to be straightforward, without complicated bonus structures or mandatory app usage.

- The fixed-rate options offer certainty, which many savers value.

The building society has also spoken about its commitment to offering cash ISAs, believing that limiting choice could harm savers. This dedication to protecting savers’ interests helps cement their place among the Best Cash ISAs, particularly if you prefer a more traditional approach to your savings.

Charter Savings Bank Fixed ISA: Competitive Digital Rates

Image Source: Charter Savings Bank

Charter Savings Bank really shines as a digital-first provider that consistently offers competitive fixed rates for ISAs. If you’re looking for guaranteed returns without fiddly bonus structures, they are definitely worth a look when considering the Best Cash ISAs.

Charter Rates: Fixed Returns Explained

Charter Savings Bank provides several fixed-rate Cash ISA options that often feature appealing interest rates. For instance, their 1-Year Fixed Rate Cash ISA has recently offered 4.27% tax-free AER paid yearly. They sometimes offer a slightly different rate if you prefer your interest paid monthly (like 4.19% AER). If you’re happy to lock your money away for a bit longer, their 18-Month Fixed Rate Cash ISA has offered rates around 4.06% tax-free AER.

Now, one thing to note is the minimum deposit – you’ll typically need £5,000 to open an account, which is higher than many other providers ask for. However, Charter does allow large maximum deposits (up to £1,500,000), making them a good option for those with significant sums to save tax-efficiently. You usually have 30 days from applying to get your deposit or transfer into the account, and you can’t add more money after that initial window closes.

Withdrawal Penalties: Locking In Your Rate

Although ISA rules mean you must be allowed to access your money if needed, taking cash out of a fixed-rate ISA early will usually result in losing some interest. The exact penalty period (e.g., 90 days’ interest, 180 days’ interest) will be clearly stated in your account’s Key Features document, so make sure you read that carefully.

The great thing about a fixed ISA like Charter’s is that your rate is locked in for the term. It won’t change even if market interest rates go up or down, giving you certainty about your returns. Your interest is calculated daily, and you can often choose whether to have it paid into your account monthly or annually.

Transferring Your ISA: In and Out

Charter makes it straightforward to transfer existing ISAs into their accounts. They accept transfers from both Cash ISAs and Stocks & Shares ISAs. You can usually kick off the transfer process when you apply online, or you can fill out their Transfer Authority Form later if you prefer. Typically, transferring a Cash ISA takes up to 15 working days, while moving a Stocks & Shares ISA might take up to 30 calendar days.

If you want to move your Charter ISA somewhere else later on, you’ll need to ask your new provider to manage the transfer for you. They will need Charter’s details, which are usually:

- Name: Charter Court Financial Services (trading as Charter Savings Bank)

- Account Number: 83495248

- Sort Code: 20-19-90

You’ll also need your specific Charter Savings Bank Cash ISA account number. Remember, ISA rules state that if you’re transferring money saved in the current tax year, you must transfer the whole amount.

Progressive Building Society Fixed ISA: Stability Meets Tradition

Image Source: Progressive Building Society

Progressive Building Society offers traditional fixed ISAs that blend competitive rates with the solid feel of a financial institution that’s been around for over 150 years! If stability is high on your list, their ISAs are well worth considering.

Progressive Rate: 4.3% Fixed for Two Years

Progressive Building Society’s 2-Year Fixed Rate ISA Bond (Issue 20) currently offers a rate of 4.30% tax-free/AER. That puts it right up there among the best fixed rate cash ISAs available today for that term.

With this account, your interest is calculated daily and paid into your account annually, usually after business hours on January 1st. Progressive is very clear about how interest is calculated, and the AER (Annual Equivalent Rate) shows you the return you’d get if the interest was compounded once a year.

This fixed rate is ideal if you want a guaranteed return over the two-year term and are happy to leave your money untouched. Progressive makes a point of contacting you before your fixed term ends to discuss your options for what to do next with your savings. If you don’t provide instructions, your funds will typically move into a variable rate instant access Cash ISA.

Terms and Access: What You Need to Know

You’ll need a minimum deposit of £500 to open this particular ISA. The maximum you can save in any tax year is the standard £20,000 ISA allowance. UK residents aged 16 or over can usually open an account, whether you’re already a member or new to Progressive.

Unlike many online-only banks, Progressive offers more traditional ways to manage your account:

- You can open and manage it in their branches, through agencies, or via post.

- They accept transfers of existing ISA funds from other providers.

- Early access is possible, but comes with quite a hefty penalty.

Be aware of that early withdrawal penalty – taking money out before the end of the two-year term means you’ll lose 180 days’ worth of gross interest on the amount withdrawn. However, there’s usually a 14-day cooling-off period right at the start where this penalty doesn’t apply if you change your mind.

A Good Fit for Long-Term Savers?

I think conservative savers who value reliability will find Progressive Building Society appealing. Their branch network offers the chance for face-to-face interaction, which is something purely digital banks can’t offer.

Their ISAs tend to be straightforward, without complex bonus rules or needing specific apps, which suits traditional savers. These ISAs usually offer significantly better returns than standard savings accounts, and your money is kept safe with FSCS protection.

I also like that Progressive contacts you personally before your fixed term ends. It’s a nice touch that helps maintain the relationship and ensures your tax-free savings plan stays on track. It’s a solid choice if you’re seeking one of the Best Cash ISAs with a traditional feel.

Close Brothers 5-Year Fixed ISA: For Larger Long-Term Savings

Image Source: The Guardian

If you’re looking to lock away a decent sum for a full five years, the Close Brothers 5-Year Fixed ISA could be an interesting option. It offers straightforward terms and aims to provide attractive rates among the best fixed rate cash ISAs for those planning long-term.

Close Brothers Rate: Locking In for Five Years

This 5-Year Fixed Rate Cash ISA has offered rates around the 4.30% fixed mark (though it’s always wise to double-check the current rate when applying, as 5-year rates can change significantly). The key benefit here is that your return is locked in for the entire five-year term – market ups and downs won’t affect it, giving you complete certainty.

Interest is calculated daily and usually compounds annually, being paid directly into your ISA account each year and again when the account matures.

This account is really designed for long-term savings goals, keeping your money invested until potentially 2030 (depending on when you open it). While you can access the money early if you absolutely have to, you’ll face significant penalties. You should only really choose this product if you’re very confident you won’t need the funds before the maturity date.

Safety and FSCS Coverage

Your money is well-protected with Close Brothers Limited. Eligible deposits are covered by the Financial Services Compensation Scheme (FSCS) up to the standard limit of £85,000 per person.

This means if you have a joint account, you could potentially have up to £170,000 protected. The FSCS aims to pay compensation quickly if a bank were to fail, typically within 7 working days. This robust safety net makes Close Brothers a secure place for your long-term savings.

Designed for High Deposit Savers?

This account is definitely geared towards those with larger amounts to save. You need a minimum deposit of £10,000 to open it, which is much higher than many other ISAs require. On the flip side, the maximum deposit allowed is a huge £2 million, making it suitable for high-net-worth individuals looking for tax-free returns on substantial sums.

Opening the account is typically done online, and you need to be 18 or over and resident in the UK. The bank provides the standard 14-day cooling-off period after opening, giving you a short window to change your mind without penalty. After that, accessing your money early will incur those hefty charges.

So, this ISA really suits savers who:

- Have significant funds (£10k+) they can comfortably lock away for five years.

- Prioritise a guaranteed return over potential market fluctuations.

- Want to maximise tax-free interest on larger savings pots.

It’s a strong contender in the Best Cash ISAs market for this specific type of long-term, high-balance saver.

Virgin Money Easy Access ISA: Flexibility is King

Image Source: Virgin Money

Virgin Money’s Cash ISAs really aim to hit that sweet spot between easy access to your money and competitive interest rates. If flexibility is your top priority when searching for the Best Cash ISAs, these options offer versatile ways to save tax-free.

Virgin Money Rates: Access vs. Exclusivity

Virgin Money often has different rates depending on your relationship with them. Their Defined Access Cash E-ISA currently offers a 4.06% variable rate, but be aware this rate drops to 1.25% if you make more than three withdrawals in a year. They also promote an Easy Access Cash ISA Exclusive, which has recently offered higher rates (like 4.51% tax-free/AER), but you usually need to have or open a Virgin Money current account to qualify for that premium rate. It’s worth checking their latest offers.

You can manage these accounts completely online, which is super convenient for checking transactions, adding money, or taking it out. Like all ISAs, the standard £20,000 annual allowance applies. You can usually make your first deposit using a debit card, and it starts earning interest straight away, although there might be a short hold (around six working days) before you can withdraw those initial funds.

Withdrawal Flexibility: A Major Perk

Here’s where Virgin Money really stands out for me. Their Easy Access Cash ISAs are typically fully flexible. This is brilliant because it means you can take money out if you need it unexpectedly, and then put it back in later within the same tax year without it eating into your £20,000 allowance. This offers much more freedom than many competitors on our best cash ISAs list provide.

There are usually no penalties for taking money out, and you can withdraw amounts as small as £1. Getting your money is easy via online banking:

- Transfer instantly to another Virgin Money account.

- Use Faster Payments for electronic transfers up to £100,000 to other UK accounts.

- Arrange a CHAPS transfer for larger amounts (often free over £100,000).

Good for Everyday Savers?

Virgin Money makes ongoing saving easy, typically allowing unlimited deposits throughout the year. They also accept transfers in from existing Cash ISAs and Stocks & Shares ISAs without any limit, which is great for consolidating your savings. And of course, your money is safe thanks to FSCS protection up to £85,000.

Like other good providers, Virgin Money usually gets in touch before any fixed-term products mature to discuss your options. Overall, these Virgin Money Cash ISAs seem particularly well-suited for savers who value being able to dip into their funds easily and frequently, while still wanting decent cash ISA rates. The flexibility aspect is a huge plus point for many.

Post Office Cash ISA: Trusted Name, Simple Options

Image Source: The Sun

The Post Office is such a familiar and trusted name on the high street, and they bring that reliability to the Cash ISA market. Partnering with OneFamily, they offer a blend of traditional service and competitive rates, making them a solid choice for many savers looking for the Best Cash ISAs.

Post Office Rates: Bonus vs. Fixed

The Post Office offers a few different ISA options (it’s always best to check their very latest rates when you apply). Recently, their Online ISA has featured a headline rate around 4.05% tax-free/AER variable for the first 12 months. Be aware this rate often includes a significant fixed bonus (like 2.80%), meaning the rate drops quite a bit after the first year, down to around 1.25% tax-free/AER variable.

If you prefer the certainty of a fixed rate, they usually offer options like a 1-year Fixed Rate Cash ISA (recently around 3.95% tax-free/AER fixed) or a 2-year term (around 3.80% tax-free/AER fixed).

Interest on their ISAs is calculated daily. With the Easy Access options, interest is typically paid annually on March 20th. For the Fixed Rate products, interest is added on the account’s anniversary and again when the term ends.

Accessibility and Trust: How to Manage

Unlike many newer online-only banks, the Post Office gives you choices in how you open and manage your account:

- Pop into a branch.

- Apply by post.

- Request an application pack over the phone.

Different products have different minimum deposits – often £100 for Easy Access accounts and £500 for Fixed Rate options. Your money is held securely, with Bank of Ireland UK usually acting as the ‘deposit taker’, meaning your savings are protected by the Financial Services Compensation Scheme (FSCS).

The Easy Access products generally allow unlimited withdrawals without penalty. However, if you need to get your money out of a Fixed Rate ISA early, you’ll face a Breakage Fee – typically 90 days’ lost interest for 1-year terms and 180 days’ lost interest for 2-year terms.

Appealing to Traditional Savers?

Post Office Cash ISAs can adapt to different needs. Their Online ISA often functions like a single ‘wallet’, allowing you to potentially hold different products (like easy access and fixed rate) under one umbrella, managing your allowance efficiently.

You can save up to the full £20,000 ISA allowance for the 2025/26 tax year. Transfers from existing ISAs held elsewhere are usually accepted, allowing you to consolidate without affecting your current year’s allowance.

I think Post Office Cash ISAs are particularly well-suited for people who:

- Feel comfortable dealing with established financial institutions that have a physical presence.

- Prefer traditional methods for managing their money (branch, post).

- Want straightforward products without needing complex apps.

They offer a dependable route to tax-free savings, making them a strong contender for savers seeking reliability among the Best Cash ISAs.

Ford Money 3-Year Fixed ISA: Solid Mid-Term Option

Image Source: Ford Money

Ford Money’s 3-Year Fixed ISA often ranks among the best fixed rate cash ISAs for 2025. If you’re looking for a straightforward product to lock your money away for the medium term, I think this one is worth a look.

Ford Money Rate: Locking In 4.20% AER

This 3-Year Fixed Cash ISA has recently offered a 4.20% AER (Tax-Free) fixed interest rate. That rate stays locked in for the whole three years, no matter what happens with wider market interest rates – great for certainty!

Interest is calculated daily. You can usually choose to receive your interest payments annually at the 4.20% Gross rate, or monthly at a slightly different rate (like 4.12% Gross). To give you an idea, putting £1,000 in could grow to roughly £1,131 after the three years are up.

You’ll need a minimum opening balance of £500 for this account. Once opened, you typically have 21 days to make deposits. Ford Money allows a maximum balance of up to £2,000,000 across all your accounts with them.

Withdrawal Penalties: The Cost of Early Access

Like most fixed-rate products, taking your money out early comes with significant penalties. Ford Money usually charges a term breakage fee equal to 270 days’ worth of gross interest on the amount you withdraw. For example, if you took money out after just 30 days, you’d earn interest for those 30 days but then lose 270 days’ interest as a penalty.

There are exceptions, though. You get the standard 14-day cancellation period after your first deposit, during which you can close the account without penalty. But generally, withdrawing early from a £10,000 deposit could easily cost you hundreds of pounds in lost interest.

Good for Medium-Term Goals?

This ISA is particularly useful if you have specific savings goals around the three-year mark. It nicely balances giving up short-term access for a committed longer-term return. Key advantages include:

- Complete online account management – no need to visit branches.

- Your savings are protected by the FSCS up to £85,000.

- Your return is guaranteed, regardless of future interest rate changes.

- The fee structure is simple, without confusing bonus rates.

Ford Money typically contacts you about a month before your three-year term ends to outline your options. Be aware that if you don’t give instructions, your ISA might automatically renew into a similar term at whatever rate is common then. This feature can be helpful as it stops your savings defaulting to a very low variable rate, keeping your money working for you.

Castle Trust Bank Fixed ISA: Digital-First Fixed Rates

Image Source: Castle Trust Bank

Castle Trust Bank offers fixed-rate savings products with competitive returns via a digital-first approach, making them a notable player in the best cash ISAs market, especially if you’re comfortable banking online.

Castle Trust Bank Rates: Across the Terms

You can usually find several fixed-term e-Cash ISA options at Castle Trust Bank, with rates often ranking among the best fixed rate cash ISAs. For example, they’ve recently offered:

- 1-year Fixed Rate e-Cash ISA at 4.26% AER

- 2-year Fixed Rate e-Cash ISA around 4.17% AER

- 3-year Fixed Rate e-Cash ISA at 4.15% AER

- 5-year Fixed Rate e-Cash ISA around 4.05% AER

Interest is calculated daily on these accounts but is usually only paid out when your fixed term matures. To give you an idea, a £1,000 deposit could earn roughly £42.60 interest over one year, £85.14 over two years, £129.74 over three years, or £219.58 over five years at those rates.

These accounts typically require a minimum deposit of £1,000 and allow balances up to £500,000. If you need to withdraw money early, expect penalties based on your term length:

- 1-year term: 90 days’ interest penalty

- 2-year term: 180 days’ interest penalty

- 3-year term: 270 days’ interest penalty

- 5-year term: 360 days’ interest penalty

Digital Access and Requirements

Castle Trust Bank operates entirely online through their Self Service Portal and mobile app. To open an ISA, you’ll need to be 18 or older, live in the UK with a National Insurance number, and have a UK current account linked for transactions.

Once your account is open, you usually have 14 days to fund it with your deposit or transfer. If no money goes in during this window, the bank will likely close the account. Your eligible savings are protected by the FSCS up to the standard £85,000 limit.

Best for Tech-Savvy Savers?

The e-Cash ISA range is definitely designed for savers who are comfortable managing their finances digitally. The online portal allows you to view your accounts, download statements, and send secure messages to their support centre.

One really important thing to watch out for: if Castle Trust Bank doesn’t receive your instructions about what to do with your money when your fixed term ends, they might automatically move your funds into a ‘Maturity Holding ISA’. This account typically pays a very low variable interest rate (sometimes as little as 0.1%!). That’s a huge drop from their fixed rates. So, make sure you tell them what you want to do (reinvest or withdraw) about two weeks before your term ends to avoid this. This makes Castle Trust one of the Best Cash ISAs for digitally organised savers.

Conclusion: Finding Your Best Cash ISA Match

Wow, digging into the details really shows that the Best Cash ISAs offer much better returns than standard savings accounts here in 2025! Top performers like Moneybox (hitting 5.71% AER variable, albeit with a short bonus), Plum (with recent bonus-driven peaks like 5.68% AER variable), and Trading 212 (offering 4.5% AER variable standard, plus promotions pushing over 5.07%) are providing substantially better rates than many regular products. This tax-free advantage feels even more valuable with the ISA allowance frozen until 2030 and ongoing talk about potential future changes.

But remember, choosing your ideal cash ISA involves looking beyond just the headline rate. Think about how you need to access your money. Moneybox limits you to three withdrawals a year to keep its top rate, while fixed options like Charter Savings Bank hit you with hefty interest penalties if you need cash early. Minimum deposits vary wildly too, from just £1 with Trading 212 up to £10,000 for Close Brothers’ long-term fixed ISA, making some options more accessible than others.

Bonus rates need a careful eye too! Those attractive initial rates often drop significantly once the bonus period ends. Plum’s rate, for example, drops to around 3.54% after the bonus, and the Post Office Online ISA rate falls sharply from around 4.05% to just 1.25%. The good news is that FSCS protection covers eligible deposits up to £85,000 per person with all these providers, keeping your money safe regardless of which you choose.

Ultimately, your personal situation and savings goals should guide your decision. If you need regular access, a flexible option like Virgin Money’s easy access ISA (offering around 4.06% or potentially higher if you bank with them) might be perfect. If you’re focused on longer-term goals and want certainty, a fixed product like Progressive Building Society’s 4.3% two-year rate could be ideal. The smartest move? Compare these top 12 Best Cash ISAs against your specific needs to maximise your tax-free savings before any potential allowance rules change. Making your money work harder often goes hand-in-hand with overall financial well-being, much like knowing how to improve your credit score helps your borrowing power.

Best Cash ISAs: Your Questions Answered (FAQs)

Got a few more questions buzzing around about finding the Best Cash ISAs? No worries, I’ve put together answers to some common queries!

Q1. What is the current ISA allowance for 2025/26?

Good news! The ISA allowance for the 2025/26 tax year (which runs from 6th April 2025 to 5th April 2026) remains unchanged at £20,000 per person. This means you can save up to that amount across your different ISA types (like Cash, Stocks & Shares, etc.) completely tax-free.

Q2. Which provider offers the highest interest rate on cash ISAs?

Right now (as of April 2025), Moneybox is leading the pack with their Cash ISA offering a 5.71% AER variable rate. However, remember this includes a 1.51% bonus that only lasts for the first three months, and you need to meet certain conditions (like minimum balance and limited withdrawals) to keep it. Interest rates on the Best Cash ISAs can change pretty quickly, so it’s always smart to compare the latest offers before you commit.

Q3. Are there any penalties for withdrawing money from a cash ISA?

It really depends on the specific ISA! Penalties for taking your money out vary a lot. Some easy-access Cash ISAs, like the flexible ones offered by Virgin Money, let you make unlimited withdrawals without any penalty at all. On the other hand, if you choose a fixed-rate Cash ISA, taking your money out before the end of the agreed term nearly always means you’ll lose a chunk of interest – sometimes 90 days’ worth, sometimes 180 days’, or even more! Always check the specific product’s terms.

Q4. What should I consider when choosing between different cash ISA options?

Finding the right fit from the Best Cash ISAs means looking beyond just the headline interest rate. Key things I always check are:

- The Rate: Is it fixed or variable? Does it include a bonus that disappears later?

- Withdrawal Rules: Can you access your money easily? Are there limits or penalties? Is it a ‘flexible’ ISA (allowing you to replace withdrawn funds)?

- Minimum Deposit: How much do you need to open the account?

- Account Management: Do you prefer an app, online banking, or branch access?

- Your Goals: How long can you realistically lock your money away for?

Matching these factors to your own saving habits and needs is crucial.

Q5. Are cash ISAs still worthwhile compared to regular savings accounts?

Yes, definitely! For many savers, hunting down the Best Cash ISAs is still very worthwhile. The main benefit is that all the interest you earn is completely tax-free, forever. This is especially helpful if you’re a higher-rate taxpayer or if you have enough savings that the interest might push you over your Personal Savings Allowance (£1,000 for basic rate, £500 for higher rate taxpayers outside an ISA). Plus, as we’ve seen, the interest rates on the top Cash ISAs right now are very competitive, often beating what you can get from standard savings accounts.