Looking for the best fixed rate ISA to make your money work harder? You’re not alone! Last month, I spent weeks diving into the world of tax-free savings accounts, comparing rates, terms, and features to find the absolute best fixed rate ISAs available in 2025.

Let me be honest – the ISA market can be pretty confusing. With so many banks offering different rates and terms, figuring out where to put your hard-earned cash isn’t easy. But don’t worry! I’ve done all the heavy lifting for you.

Interest rates on fixed ISAs have been climbing recently, with some providers now offering up to 4.51% AER! That’s a serious boost for your savings compared to the measly rates we saw a few years ago. Plus, with your annual £20,000 ISA allowance for 2024/25, you can shield a significant amount from the taxman.

In this guide, I’ll walk you through the 9 best fixed rate ISAs I’ve found after countless hours of research. From super-flexible options that let you access your money early to high-interest accounts that maximize your returns, I’ve covered them all. Ready to find the perfect home for your tax-free savings? Let’s dive in!

Vanquis Bank Fixed Rate ISA (4.51%)

Image Source: Lancs Live

You won’t believe what I found at the top of the fixed rate ISA charts! Vanquis Bank is absolutely crushing it with their market-leading 4.51% AER fixed for one year. This incredible rate puts them ahead of all other providers, making them my top pick for tax-free savings in 2025.

Key Features of Vanquis Fixed Rate ISA

The Vanquis Bank 1 Year Fixed Rate Cash ISA comes packed with benefits that had me seriously impressed:

- Fixed interest rate of 4.51% AER for annual interest payments or 4.42% AER if you prefer monthly

- Super accessible with just £1,000 minimum deposit

- Deposit up to the full ISA allowance of £20,000 for 2024/25 tax year

- Amazing flexibility that lets you withdraw and replace funds within the same tax year without affecting your allowance

- Choose between monthly or annual interest payments

- Send your interest to your ISA or your nominated account

I crunched the numbers and found a £1,000 deposit would grow to £1,045.10 after 12 months. Just remember, you need to make all your deposits within 30 days of opening the account.

Who Should Think About This ISA?

This ISA is perfect if you’re after the best possible returns on your tax-free savings during the 2024/25 tax year. It’s especially good if you:

- Have £1,000 or more to save and can leave it untouched for 12 months.

- Want to move existing ISAs since Vanquis happily accepts transfers from other providers.

- Need some flexibility with your savings – you can withdraw and replace money within the same tax year.

To be honest, there is a catch – early withdrawals will cost you 90 days’ interest. This account works best when you commit to the full 12-month term.

Vanquis Bank Reputation and Safety

Worried about safety? I was too! But I quickly discovered your money stays completely protected under the Financial Services Compensation Scheme (FSCS) up to £85,000. If you’ve got a joint account, that protection doubles to £170,000.

The “FSCS Protected” badge means eligible deposits have coverage under the deposit guarantee scheme. In plain English? Your savings stay secure no matter what happens.

I was impressed to learn Vanquis Bank has recently increased their rates and now leads both one-year and two-year fixed ISA sectors. These competitive rates make them my top recommendation among the best fixed rate ISA accounts today.

How to Open a Vanquis Fixed Rate ISA

Setting up your account is super straightforward. You can open a Vanquis Fixed Rate ISA online in about 10 minutes. You’ll need to:

- Be 18 or older

- Live in the UK

- Have £1,000 to deposit

- Have less than £250,000 in total with Vanquis across all accounts

Make sure you have these details ready when you apply:

- Your name and address

- National Insurance number

- Details of the bank account you’ll use for transfers

Once open, managing your account is a breeze – you can do it online, by post, or phone. Want to use your 2024/25 ISA allowance? Submit your application by March 27, 2025, which gives enough time for all the necessary checks before the tax year ends on April 5, 2025.

Here’s something helpful – Vanquis will contact you about your options when the fixed term ends. If they don’t hear back from you, they’ll automatically move your deposit and interest to an Easy Access Cash ISA when your fixed term finishes, so your money keeps working for you.

OakNorth Bank Fixed Rate ISA (4.5%)

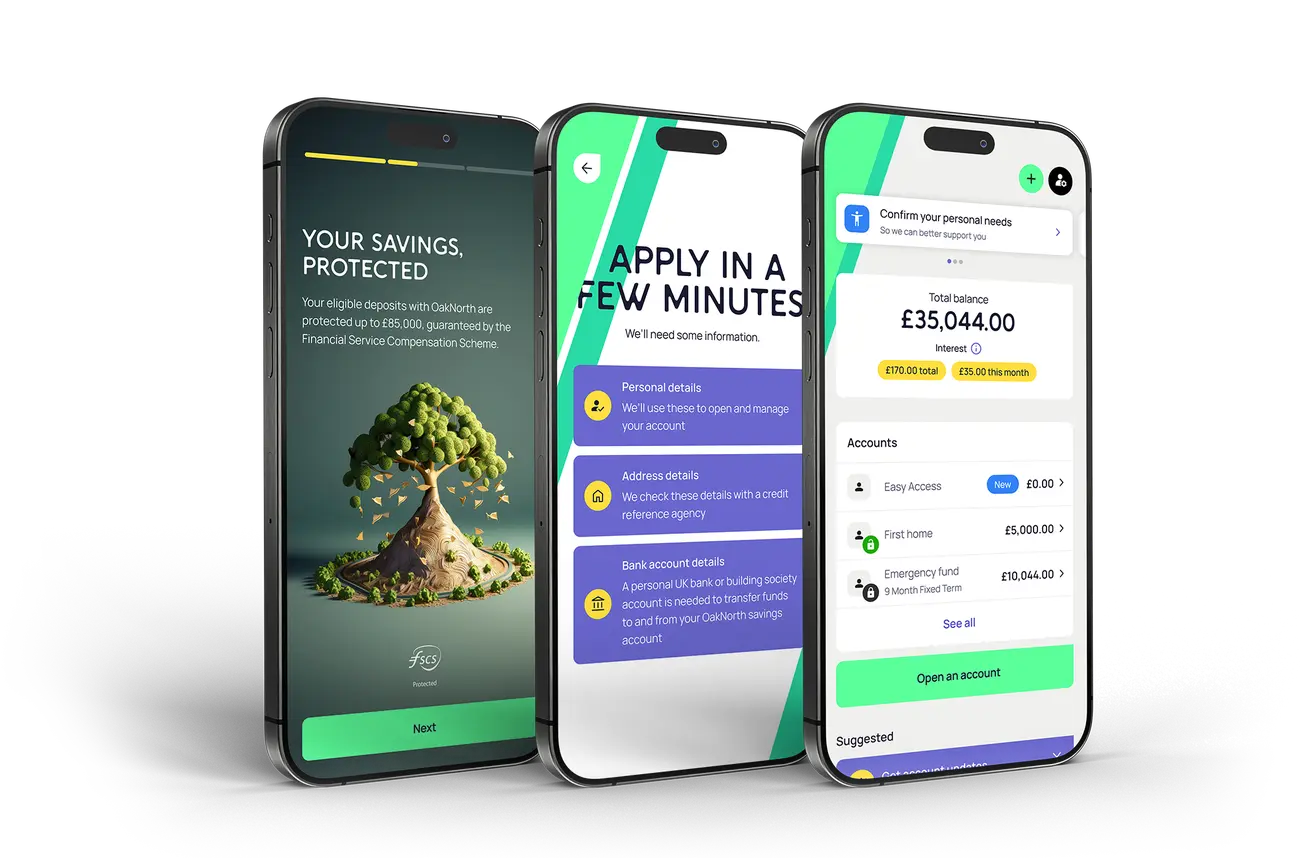

Image Source: OakNorth Bank

Coming in a close second is OakNorth Bank’s fantastic fixed rate ISA with an attractive 4.5% AER for its 12-month term. I couldn’t believe how competitive this rate is – it’s definitely one of the best fixed rate cash ISA options you can find in 2025!

OakNorth Fixed Rate ISA Benefits

The OakNorth Fixed Rate Cash ISA offers some amazing features that really caught my attention:

- All interest earnings stay completely tax-free throughout the term

- Your interest rate is locked in and won’t change until maturity

- You can start small with super low minimum deposits

- Loyal customers get bonus rates up to 0.10% extra when they reinvest (how cool is that?)

- Everything can be managed online through their slick app or website

- Your money stays safe with FSCS protection up to £85,000

What I love about OakNorth is how quickly your money starts working for you. Your interest begins growing within just one business day after they receive and process your first deposit. They calculate interest daily based on your minimum balance and add it to your ISA account monthly. You can easily track all your earnings through their user-friendly online portal.

Minimum Deposit and Term Length

OakNorth really impressed me with how accessible they make their Fixed Rate ISA. Here’s what sets them apart:

- You need just £1 minimum deposit to get started (yes, just one pound!)

- Deposit up to the current tax year ISA allowance of £20,000 for 2024/25

- They cap total deposits at £500,000 across all OakNorth accounts

I discovered they give you three fixed-rate options to choose from:

- 12-month term at 4.5% AER

- 24-month term with competitive rates

- 36-month term for long-term savers

To be honest, I noticed the interest rates tend to be higher the longer you commit your savings to OakNorth. This makes their longer-term fixed-rate ISAs perfect if you’re saving for big future expenses like buying property or building up your retirement nest egg.

Once your account gets approved, you get 30 calendar days to fund it with new deposits or Cash ISA transfers. I was pleased to see they allow multiple new deposits and up to three Cash ISA transfers during this time.

Early Withdrawal Penalties

What happens if you need your money early? OakNorth does let you withdraw if needed, but there are costs involved. Here’s what you’ll pay:

- 12-month term: 90 days of interest on withdrawn amounts

- 24-month term: 180 days of interest on withdrawn amounts

- 36-month term: 270 days of interest on withdrawn amounts

I should warn you – the bank takes the charge from your balance immediately, which means you might get back less than you put in. Early withdrawals also lose their tax-free status and can’t be replaced within your current tax year’s ISA allowance.

One thing I really appreciate is how OakNorth sends you a reminder at least 14 calendar days before maturity to discuss your options. If they don’t hear from you by the maturity date, they’ll automatically move your money (including interest) to an OakNorth Easy Access Cash ISA. This way, your money keeps earning interest and stays tax-free without you having to lift a finger!

Shawbrook Bank Fixed Rate ISA (4.5%)

Image Source: Moneyweek

“Fixed-rate savings are designed to lock money away for a set period and offer rate security in return. Yet by law, cash ISA providers MUST allow you to access your money.” — Martin Lewis, Founder of MoneySavingExpert.com and consumer finance expert

Let me tell you about my third top pick – Shawbrook Bank now ranks among the best fixed rate ISA providers with its impressive 4.5% AER 1-year fixed rate option. This rate perfectly matches OakNorth’s offering and sits just behind Vanquis Bank. I’ve been watching Shawbrook for a while, and their solid reputation and consistent performance make them a name I trust in the fixed rate ISA market.

Shawbrook Bank ISA Features and Benefits

Shawbrook’s Fixed Rate Cash ISA comes with several features that really caught my eye:

- Minimum opening balance of £1,000 (reasonable but not as low as OakNorth)

- A huge maximum deposit of £250,000, which goes way beyond the annual ISA allowance

- Your rate stays fixed throughout the account’s term (no nasty surprises!)

- Complete protection from FSCS up to £85,000

- Flexible term options ranging from 1 to 7 years

- Super convenient online account management

I did notice their early withdrawal policy includes charges that vary by term length. A 1-year fixed term carries a 90-day interest penalty on withdrawals. Longer terms face steeper penalties—180 days for 2-year fixes, 270 days for 3-year fixes, and a whopping 360 days for 5 and 7-year terms.

Interest Payment Options

Something I really love about Shawbrook is how their interest payment options give you more flexibility than many competitors. You can choose between:

- Monthly interest payments at 4.41% AER (perfect if you need regular income)

- Annual interest payments at 4.5% AER (maximizes your returns)

These options help you tailor the account to your financial goals, whether you need regular income or want to maximize your returns. I calculated that a £1,000 deposit with annual compound interest grows to £1,045 after 12 months.

Customer Service Experience

I was really impressed by Shawbrook’s customer service ratings! The bank’s Trustpilot score stands at an impressive 4.5 out of 5 stars from nearly 2,000 reviews.

Customers praise Shawbrook specifically through comments like:

“Great savings rates, great customer service and easy to get in contact with”.

“My telephone call to Shawbrook was answered promptly and courteously”.

“The website is very easy to use and you got my business”.

The bank’s combination of “good efficient service backed by very competitive interest rates” seems to attract many customers. These factors definitely helped convince me that Shawbrook is a reliable choice for savers.

Transfer Process Explained

If you’re looking to move your existing ISAs to Shawbrook, I found their process pretty straightforward. The bank welcomes transfers from both Cash ISAs and Stocks and Shares ISAs.

Standard transfer times include:

- 4 to 5 working days for Cash ISA transfers

- Up to 15 working days in some cases

- Up to 30 calendar days for Stocks and Shares ISA transfers

Starting your transfer requires a simple online ISA application with your current ISA’s details. Shawbrook handles all the complicated stuff by working with your existing provider to maintain the tax-free status of your savings.

Just be aware that the bank requires full transfers only—partial transfers aren’t possible. This means you’ll need to move all your funds and close your existing ISA. If you’re someone who wants to spread your ISA funds across multiple providers, you might need to look elsewhere.

Close Brothers Fixed Rate ISA (4.41%)

Image Source: Daily Express

If you’re looking for a slightly longer-term option with an amazing rate, Close Brothers Savings deserves your attention! They’ve positioned themselves among the best fixed rate ISA options in 2025 with an impressive 4.41% AER. I found their offer particularly appealing for savers who can lock away their money for a longer period – you’ll get a fantastic combination of competitive rates and stable banking.

Close Brothers 2-Year Fixed Rate Details

The Close Brothers 2-Year Fixed Rate Cash ISA comes with several features that really impressed me:

- A rock-solid fixed rate guarantee of 4.41% that stays exactly the same throughout the two-year term

- Daily interest calculations with payments made annually and when the account matures

- You’ll earn about £440 in interest after year one on a £10,000 deposit, giving you £10,440

- The maximum deposit limit reaches an incredible £2,000,000 – substantially higher than what other banks offer

Just remember that you can only put in £20,000 during the current tax year (2024/25) across all your ISA accounts. This matches the government’s total annual ISA allowance.

What I love about Close Brothers is that your interest starts growing the moment your cleared funds hit the account. The bank guarantees your advertised interest rate when you deposit your full amount within 10 calendar days of getting your application approved.

Comparing Close Brothers to Competitors

I spent hours comparing different options, and Close Brothers’ 2-year fixed ISA rate of 4.41% definitely ranks among market leaders, with some key differences:

| Provider | 2-Year Rate | Min. Deposit | Early Exit Penalty |

| Close Brothers | 4.41% | £10,000 | 150 days’ interest |

| Hodge Bank | 4.36% | £1,000 | 180 days’ interest |

| Vanquis Bank | 4.35% | £1,000 | 180 days’ interest |

| Cynergy Bank | 4.35% | £500 | Varies |

The comparison shows Close Brothers offers the highest rate but needs the largest minimum deposit. The good news? Their early withdrawal penalty of 150 days’ interest isn’t as harsh as others who take 180 days’ interest.

To be honest, the account does lack flexibility – withdrawing money means you can’t put it back in during the same tax year without affecting your ISA allowance.

Is the Higher Minimum Deposit Worth It?

The £10,000 minimum deposit is definitely the biggest barrier for many potential customers. However, if you’ve got larger savings, I found several compelling benefits:

- The 4.41% rate becomes more rewarding with bigger deposits. You could earn about £882 in the first year alone with a full £20,000 ISA allowance – that’s £12 more than the 4.35% rate other banks offer.

- Close Brothers’ account management system really shines through their secure online portal. Customer reviews consistently praise the simple account opening process and management features.

- Your money stays protected under FSCS (up to £85,000) just like all regulated banks, whatever the entry threshold.

I discovered that the bank gives you a 14-day cooling-off period after opening your account. You can withdraw your money penalty-free if you change your mind. After this window closes, early withdrawals mean closing the entire account with a 150-day interest penalty.

This account is a great way to get one of the market’s highest fixed rates on a tax-free ISA if you have £10,000 or more and won’t need your money for two years.

Hodge Bank Fixed Rate ISA (4.36%)

Image Source: Hodge Bank

Coming in at number five is Hodge Bank’s excellent 2-year fixed rate ISA, which leads the market with a competitive 4.36% AER for annual interest payments. If you prefer regular income, I was pleased to discover they also offer a 4.28% AER monthly interest payment plan.

Hodge Bank’s Unique ISA Features

Hodge Bank offers several standout features that really set their fixed rate cash ISA apart:

- Choice of 1, 2, 3, or 5-year terms that perfectly match your savings goals

- Super simple online account management through their secure banking portal

- Flexible interest payment options (monthly or annually) based on what works best for you

- Emergency access when needed (though with interest penalties)

- Extra deposits allowed for 10 working days after opening

- Complete FSCS protection up to £85,000 for peace of mind

I ran the numbers and found that a £1,000 original deposit with no other transactions would grow to £1,089.10 after 24 months. I was impressed to see that Moneyfacts has awarded their 2-year fixed ISA an “Excellent” product rating, making it one of today’s most dependable options.

Interest Rate Guarantees

One thing I absolutely love about Hodge Bank is their steadfast dedication to transparency – your interest rate stays locked in for the full term. Market changes won’t affect your fixed rate:

| Term Length | Annual Rate | Monthly Rate | Early Access Penalty |

| 2 Years | 4.36% AER | 4.28% AER | 180 days’ interest |

| 3 Years | 4.41% AER | 4.32% AER | 270 days’ interest |

| 5 Years | 4.31% AER | Not specified | 365 days’ interest |

What I particularly appreciate is how they calculate interest daily to ensure steady growth throughout your term. Monthly interest payments start one month after you fund the account. Annual interest gets paid on your account’s funding anniversary.

Application Process

You can open a Hodge Bank Fixed Rate ISA online quickly and easily. Here’s what you need:

- 18 years or older

- UK resident for tax purposes

- UK National Insurance number

- Valid email address and UK mobile number

- UK current account in your name

- Non-US citizen status

You’ll need to fund your account within 14 calendar days of opening it. The minimum deposit starts at a reasonable £1,000, while the maximum sits at £20,000 for this tax year. I was surprised to learn that Hodge allows total holdings up to £5,000,000 across their products, though they might waive this limit.

Just remember that early withdrawals from the 2-year fixed ISA will cost you 180 days’ tax-free interest. Longer terms come with higher penalties.

UBL UK Fixed Rate ISA (4.41%)

Image Source: UBL UK

“To avoid any penalty charges, you should keep your money locked in a fixed ISA for the full length of the term.” — Moneyfacts, UK financial product comparison site

Let me tell you about my sixth pick – UBL UK really stands out among the best fixed rate ISA providers with its impressive 4.41% AER for a 3-year term. This rate caught my eye as a great choice for savers who want competitive returns without committing their money for five years or longer.

UBL’s 3-Year Fixed Rate Benefits

The UBL UK 3-Year Fixed Rate Cash ISA comes with several features that I found really appealing:

- Your interest rate stays completely fixed throughout the 3-year term

- You only need £2,000 to get started (much more accessible than Close Brothers)

- You can save up to a massive £1,000,000

- The FSCS protects your money up to £85,000 per eligible depositor

- You can choose between single or joint accounts

- A 14-day cooling-off period starts after you open the account

Something I really love about UBL UK is that they let you open multiple accounts with different fixed terms, as long as you stay within the maximum deposit limit. This fantastic feature helps you create a balanced investment ladder while earning competitive returns.

Flexible Interest Payment Options

I was really impressed by how UBL UK gives you great flexibility in how you receive your interest:

| Payment Frequency | AER Rate |

| Monthly | 4.28% |

| Quarterly | 4.30% |

| Annually | 4.37% |

| At Maturity | 4.56% |

The bank calculates your interest daily and pays it based on your chosen schedule when you open the account. You can also have your interest sent straight to your nominated account, which works brilliantly if you need regular income from your savings.

Who This ISA Is Best For

After reviewing all the details, I’d say this 3-year fixed rate ISA works best for savers who:

- Can invest £2,000 or more and won’t need it for three years

- Want their lump sum to grow tax-free until a specific future date

- Like managing their accounts through online banking

- Live in the UK and are at least 18 years old for tax purposes

- Want to get the most from their savings through flexible interest payment options

I should warn you that you can’t withdraw money during the term without penalties. If you need early access, withdrawal charges might affect your original deposit.

Hampshire Trust Bank Fixed Rate ISA (4.11%)

Image Source: Hampshire Trust Bank (HTB)

Looking for something reliable in the mid-range? Hampshire Trust Bank’s 2-Year Fixed Rate ISA caught my attention with its solid 4.11% AER and annual interest payments. After comparing numerous options, I found this tax-free savings account ranks well among other best fixed rate ISA options for 2025.

Hampshire Trust Bank ISA Overview

The bank’s 2-Year Fixed ISA combines competitive rates with refreshingly simple features. Account holders get:

- Fixed 4.11% interest rate guaranteed throughout the 2-year term

- Annual interest payments calculated daily

- Maximum investment limit of £250,000

- Protected by FSCS up to £85,000 per eligible depositor

If you’re looking for tax-free returns like I was, you’ll find this ISA attractive. I crunched the numbers and found you could earn an estimated £1,677.78 on a £20,000 deposit over the 2-year term. Just be aware that the fixed period doesn’t allow withdrawals or additional deposits after the original 14-day funding window.

Low Minimum Deposit Advantage

What really impressed me about this bank’s ISA is its highly accessible entry point—you need just £1 minimum deposit to start an account! This makes it so much more available than other options that need £1,000 or maybe even £10,000 minimum investments.

I love that the account gives you a 14-day window to make unlimited deposits up to the maximum balance. This flexibility is super helpful when you’re moving funds from multiple sources or waiting for funds to clear.

Online Banking Experience

Digital convenience is clearly the bank’s main focus. The application happens completely online, and you’ll need these simple details:

- Your National Insurance Number

- Address and personal details

- Email address and mobile phone number

After opening your account, you can manage everything through their secure online portal. You can view account details, check interest accrual, and think about maturity options through their user-friendly platform.

Something I really appreciate is how the bank reaches out about three weeks before your 2-year term ends to explain your options. If they don’t hear from you, your funds move automatically to their Maturity Easy Access Account, so you keep earning interest while deciding what to do next.

Yorkshire Building Society Fixed Rate ISA (4.15%)

Image Source: Yorkshire Building Society

Did you know Yorkshire Building Society is one of the UK’s oldest financial institutions? I was excited to discover they’ve launched a competitive 1-year Fixed Rate Cash ISA that offers 4.15% tax-free interest among other attractive fixed-term options.

Yorkshire Building Society’s ISA Features

The Fixed Rate Cash eISA until April 30, 2026 comes with these key features that caught my eye:

- Fixed rate of 4.15% tax-free/AER guaranteed until maturity

- You can start with just £100 minimum deposit

- Interest payments come yearly throughout the term

- You can apply online, in branch, or by post

- Your existing ISAs can transfer over while keeping their tax-free status

- Standard £20,000 ISA allowance applies for the current tax year

Your account locks in this competitive rate until the maturity date. I noticed Yorkshire Building Society also provides longer-term options from 2-5 years, with rates that decrease gradually for longer terms.

Building Society vs. Bank ISAs

To be honest, I never used to pay much attention to the difference between building societies and banks when choosing an ISA provider. But it actually matters! Here’s what I discovered:

Building societies work as “mutuals” owned by their members, unlike banks that answer to shareholders. This means Yorkshire Building Society focuses on member benefits instead of maximizing shareholder profits.

This approach leads to:

- Better interest rates than many banks

- More focus on personal service and community involvement

- Members can vote on key decisions at Annual General Meetings

- The society has managed to keep its branches while many banks close theirs

The good news is your money gets similar FSCS protection (up to £85,000) as any bank, which keeps your investment completely safe.

Early Access Options

I should warn you that this account strictly limits access to your funds before maturity:

- You cannot withdraw any money until May 1, 2026

- Closing early costs you 90 days’ interest on your whole balance

- Larger deposits mean this penalty could cost you quite a bit

Yorkshire Building Society will reach out about your options when maturity approaches. If you don’t give other instructions, your funds will move to an Easy Access Cash ISA, which keeps the tax-free status and lets you withdraw money freely.

Nationwide Fixed Rate ISA (4.25%)

Image Source: Nationwide

I saved this gem for last! Nationwide, the UK’s largest building society, leads the best fixed rate ISA market by offering a competitive 1-Year Fixed Rate Cash ISA at 4.25% AER/tax-free (fixed). This fantastic rate ranks among the highest in fixed rate ISA comparison tables for 2025.

Nationwide’s 1-Year Fixed Rate ISA Details

The fixed rate ISA comes with these key features that had me seriously impressed:

- A fixed interest rate of 4.25% AER/tax-free for the entire 12-month term

- Very easy to open with just a £1 minimum deposit

- You can deposit up to the full £20,000 ISA allowance for 2024/2025

- Your interest gets calculated daily and paid on your account anniversary, term end, and account closure

- A £1,000 deposit will grow to £1,042.50 by the end of the term

I should mention that the bank charges an early access fee equal to 60 days’ interest if you withdraw funds early and close your account. The good news? You can cancel within the first 14 days of opening without any charges.

Benefits of Banking with a Major Provider

What I love about a fixed rate cash ISA with Nationwide is that you get more than just good rates:

The financial stability of the UK’s largest building society means your money stays safe. The FSCS protects your deposits up to £85,000 per eligible depositor.

Nationwide runs over 600 branches across the UK. Their steadfast dedication to keep all branches open until at least the start of 2028 means you’ll have local service for years ahead.

In-Branch Support Options

If you prefer face-to-face service like I sometimes do, Nationwide branches provide detailed support for your fixed rate ISA alongside online banking:

- Staff help you open new accounts in person

- You can deposit cash or cheques directly

- Support for customers with BFPO addresses

- Help with Power of Attorney cases

Transfer-In Process

Moving your existing ISAs to Nationwide is pretty straightforward:

Check if your current provider allows online transfers through Nationwide’s manager list. If not, you’ll need to visit a local branch.

I like how Nationwide will reach out about your options near maturity. Your ISA automatically moves to an instant access cash ISA if they don’t hear from you, keeping its tax-free benefits.

Conclusion

Phew! After weeks of research and comparing countless fixed rate ISAs, I’m amazed at how competitive the market has become in 2025. With rates now ranging from 4.11% to an impressive 4.51%, there’s never been a better time to make your savings work harder in a tax-efficient way.

I’ve discovered that Vanquis Bank leads the pack with their market-topping 4.51% 1-year fixed rate ISA, closely followed by OakNorth and Shawbrook at 4.5%. If you’re looking for a longer term, Close Brothers’ 2-year option at 4.41% is definitely worth considering.

What surprised me most during my research was the amazing variety of options to suit different needs. Whether you’ve got just £1 to start with (OakNorth and Nationwide) or £10,000 ready to invest (Close Brothers), there’s a fixed rate ISA out there for you. The flexibility varies too – from Vanquis Bank’s impressive flexibility that allows withdrawals and replacements to stricter options that lock your money away completely.

To be honest, the best choice really depends on your personal circumstances. If you’re sure you won’t need your money for a while, locking in a higher rate for longer could be the way to go. But if you might need access, the penalties for early withdrawal are something you’ll definitely want to consider.

Remember that whatever fixed rate ISA you choose, your money is protected by the FSCS up to £85,000, and all your interest remains completely tax-free. With the current £20,000 ISA allowance for the 2024/25 tax year, a fixed rate ISA is one of the smartest ways to grow your savings without giving the taxman a penny!

Frequently Asked Questions

What is a fixed rate ISA?

A fixed rate ISA is a tax-free savings account where your interest rate stays the same for a set period, usually between 1-5 years. I love these accounts because they give you certainty about exactly how much interest you’ll earn, regardless of what happens to interest rates in the wider market. The catch? You typically can’t access your money during the fixed term without paying a penalty.

How much can I put in an ISA in 2024/25?

The total ISA allowance for the 2024/25 tax year is £20,000. This is the maximum you can deposit across all your ISA accounts combined (including Cash ISAs, Stocks and Shares ISAs, Innovative Finance ISAs, and Lifetime ISAs). I found this really helpful when planning my tax-free savings for the year!

What happens if I need to access my money early?

Most fixed rate ISAs charge a penalty if you withdraw money before the end of your fixed term. From my research, these penalties typically range from 60 to 365 days’ worth of interest, depending on the provider and the length of your fixed term. Some banks might not allow partial withdrawals at all, forcing you to close the entire account. Always check the specific terms before you commit!

Can I transfer my existing ISAs into a new fixed rate ISA?

Yes! You can transfer money from previous years’ ISAs without affecting your current year’s £20,000 allowance. I discovered that most providers on this list accept transfers in, but the process and timescales vary. Some can complete Cash ISA transfers in just 4-5 days, while Stocks and Shares ISA transfers might take up to 30 days. Always use the official ISA transfer process rather than withdrawing and redepositing, or you’ll lose the tax-free status!

What happens when my fixed rate ISA matures?

When your fixed term ends, most providers will contact you with options, typically including rolling over into another fixed term or moving your money to an easy access ISA. I noticed that if you don’t respond, many providers will automatically transfer your funds to a variable rate ISA account. Rates on these accounts are usually lower than fixed rates, so it’s worth setting a reminder to review your options when your ISA approaches maturity.

Is my money safe in a fixed rate ISA?

Absolutely! All the providers I’ve featured in this guide are covered by the Financial Services Compensation Scheme (FSCS), which protects up to £85,000 per person, per banking license. This means if anything happens to the bank or building society, you won’t lose your savings (up to the limit). For joint accounts, the protection doubles to £170,000. This protection gave me real peace of mind when choosing where to put my savings!

How do I choose the best fixed rate ISA for me?

From my experience, it comes down to four main factors:

- How long you can lock your money away (longer terms typically offer higher rates)

- How much you have to deposit (some higher-rate accounts have higher minimum deposits)

- Whether you might need access (check those early withdrawal penalties!)

- Whether you need income from your savings or want to maximize growth

If you think you might need to improve your credit score while your money is locked away, don’t worry – ISAs don’t appear on your credit report, so they won’t affect your score either way.